In a world where screens rule our lives and the appeal of physical printed materials isn't diminishing. Whatever the reason, whether for education as well as creative projects or simply to add the personal touch to your area, Are Unreimbursed Medical Expenses Deductible have become an invaluable resource. This article will take a dive to the depths of "Are Unreimbursed Medical Expenses Deductible," exploring the benefits of them, where they can be found, and ways they can help you improve many aspects of your lives.

Get Latest Are Unreimbursed Medical Expenses Deductible Below

Are Unreimbursed Medical Expenses Deductible

Are Unreimbursed Medical Expenses Deductible -

The 7 5 AGI threshold is pivotal to claiming medical expense deductions This rule stipulates that taxpayers can only deduct the portion of their total medical

The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your

Printables for free cover a broad variety of printable, downloadable materials online, at no cost. These resources come in various forms, like worksheets templates, coloring pages, and much more. One of the advantages of Are Unreimbursed Medical Expenses Deductible lies in their versatility as well as accessibility.

More of Are Unreimbursed Medical Expenses Deductible

What Medical Expenses Are Tax Deductible 10 Items To Deduct

What Medical Expenses Are Tax Deductible 10 Items To Deduct

Which Medical Expenses Are Tax Deductible You can deduct unreimbursed medical care expenses paid for yourself your spouse and your

Yes the medical expense deduction lets you recoup some of the cost of unreimbursed expenses from doctor visits prescriptions and other medical expenses on your tax

Are Unreimbursed Medical Expenses Deductible have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization It is possible to tailor printables to fit your particular needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Impact: These Are Unreimbursed Medical Expenses Deductible can be used by students of all ages, making the perfect device for teachers and parents.

-

The convenience of instant access many designs and templates helps save time and effort.

Where to Find more Are Unreimbursed Medical Expenses Deductible

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross Income You can deduct the cost of

You can deduct unreimbursed medical and dental expenses for yourself your spouse and your dependents Some of the costs include those for medical

Since we've got your curiosity about Are Unreimbursed Medical Expenses Deductible, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Are Unreimbursed Medical Expenses Deductible for various uses.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing Are Unreimbursed Medical Expenses Deductible

Here are some unique ways create the maximum value use of Are Unreimbursed Medical Expenses Deductible:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Unreimbursed Medical Expenses Deductible are an abundance of creative and practical resources that cater to various needs and needs and. Their accessibility and flexibility make them a great addition to your professional and personal life. Explore the vast world that is Are Unreimbursed Medical Expenses Deductible today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations in their usage. Be sure to read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with a printer or visit a print shop in your area for superior prints.

-

What program will I need to access printables that are free?

- A majority of printed materials are in the format of PDF, which can be opened using free software, such as Adobe Reader.

Are Medical Expenses Tax Deductible Capital One 20 Medical

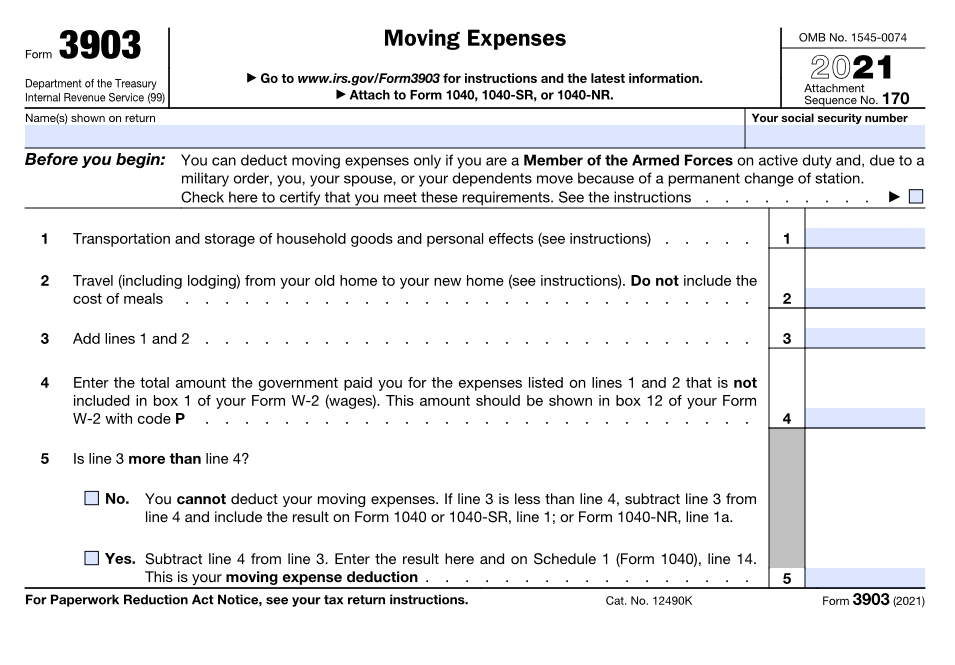

New Tax Twists And Turns For Moving Expense Deductions CPA Practice

Check more sample of Are Unreimbursed Medical Expenses Deductible below

Claim Medical Expenses On Your Taxes Health For CA

Unreimbursed Medical Expenses The VA Davidson Elder Law

Can I Deduct Medical Expenses Ramsey

Are Medical Expenses Tax Deductible Chime

Who Pays For Unreimbursed Medical Expenses For The Children YouTube

Which PCS Move Expenses Are Tax Deductible

https://turbotax.intuit.com/tax-tips/health-care/...

The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your

https://www.nerdwallet.com/article/taxe…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Are Medical Expenses Tax Deductible Chime

Unreimbursed Medical Expenses The VA Davidson Elder Law

Who Pays For Unreimbursed Medical Expenses For The Children YouTube

Which PCS Move Expenses Are Tax Deductible

Unreimbursed Employee Expenses Are They Deductible In 2022

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

Chapter 17 6