In a world with screens dominating our lives it's no wonder that the appeal of tangible printed material hasn't diminished. In the case of educational materials and creative work, or simply to add the personal touch to your home, printables for free are now a useful resource. The following article is a take a dive into the sphere of "Example Of Irs Payment Plan," exploring what they are, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Example Of Irs Payment Plan Below

Example Of Irs Payment Plan

Example Of Irs Payment Plan -

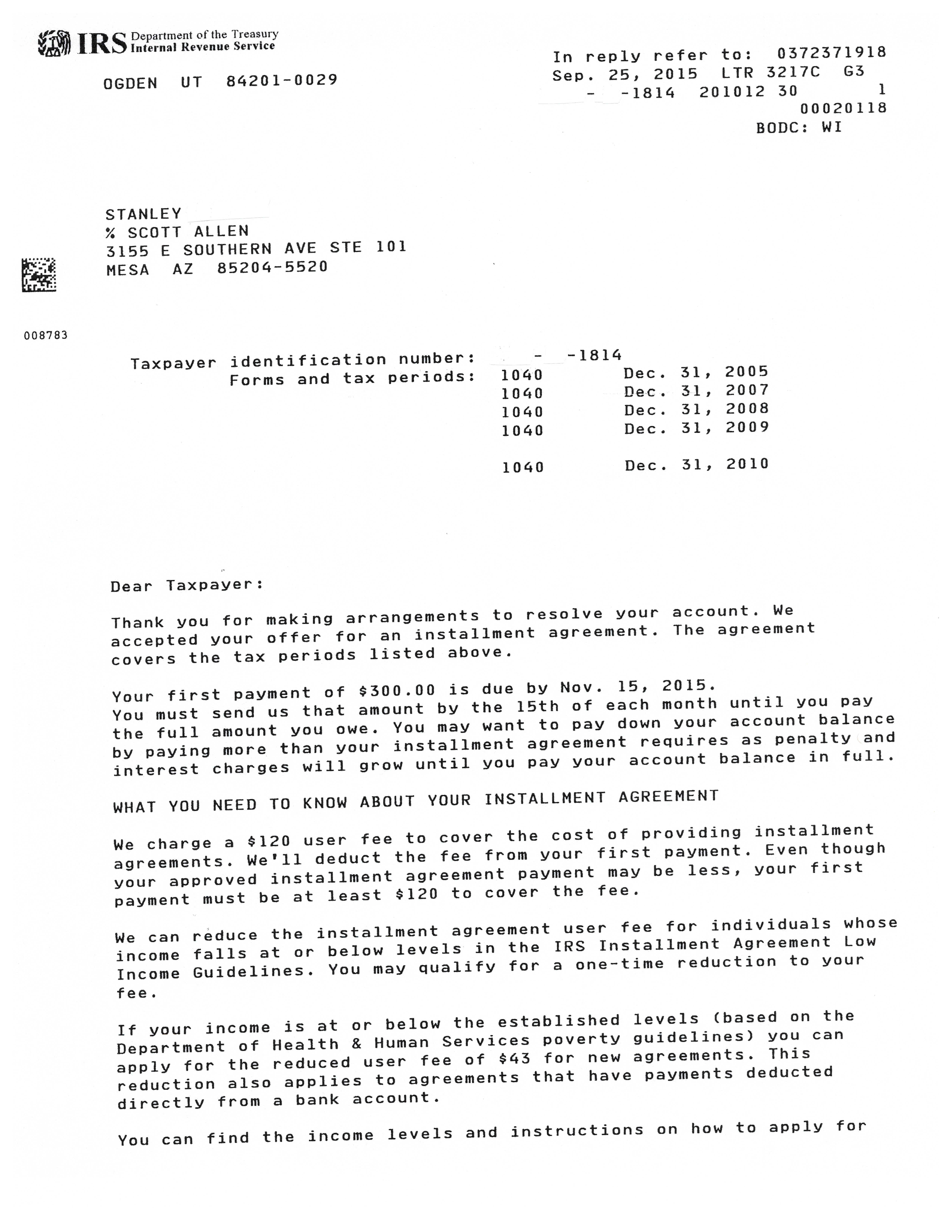

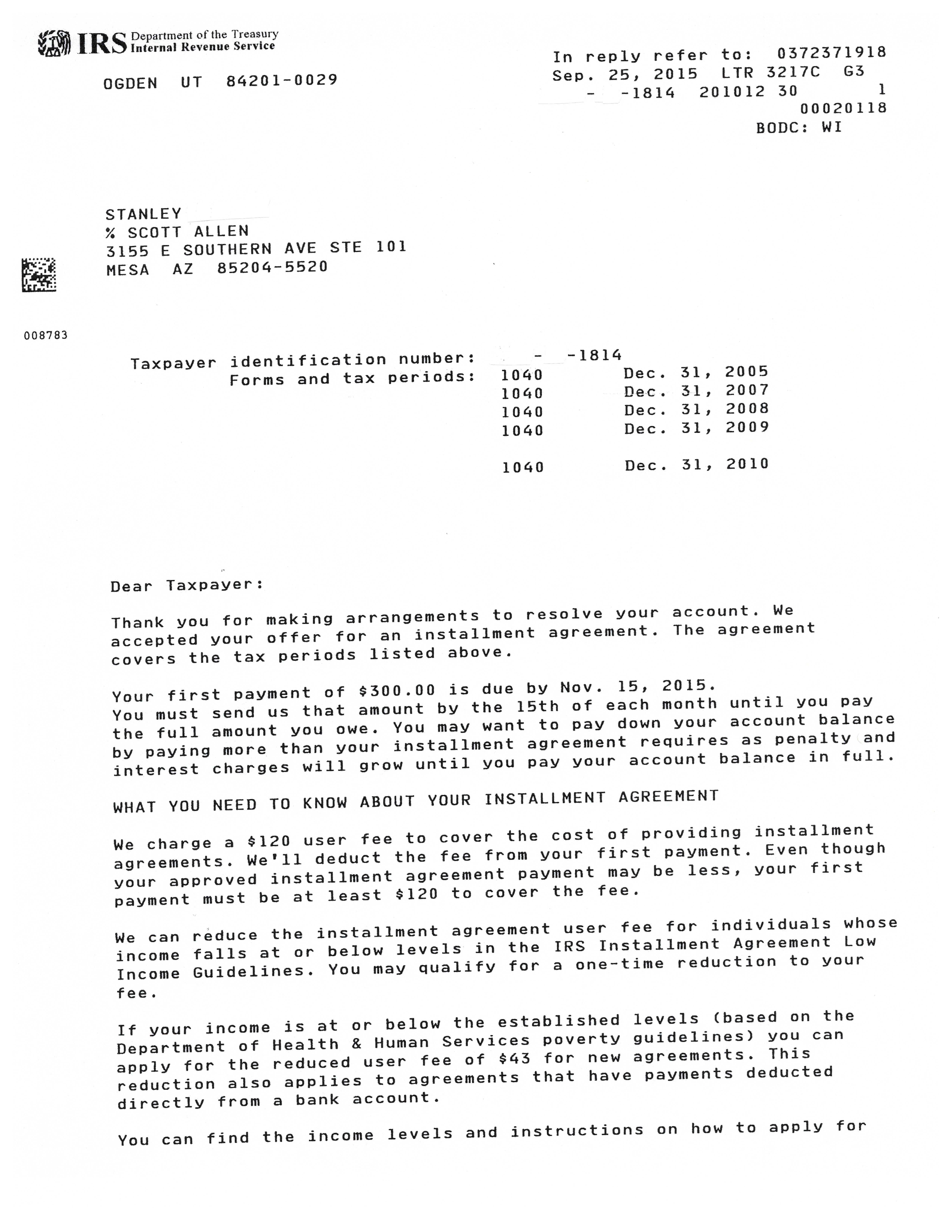

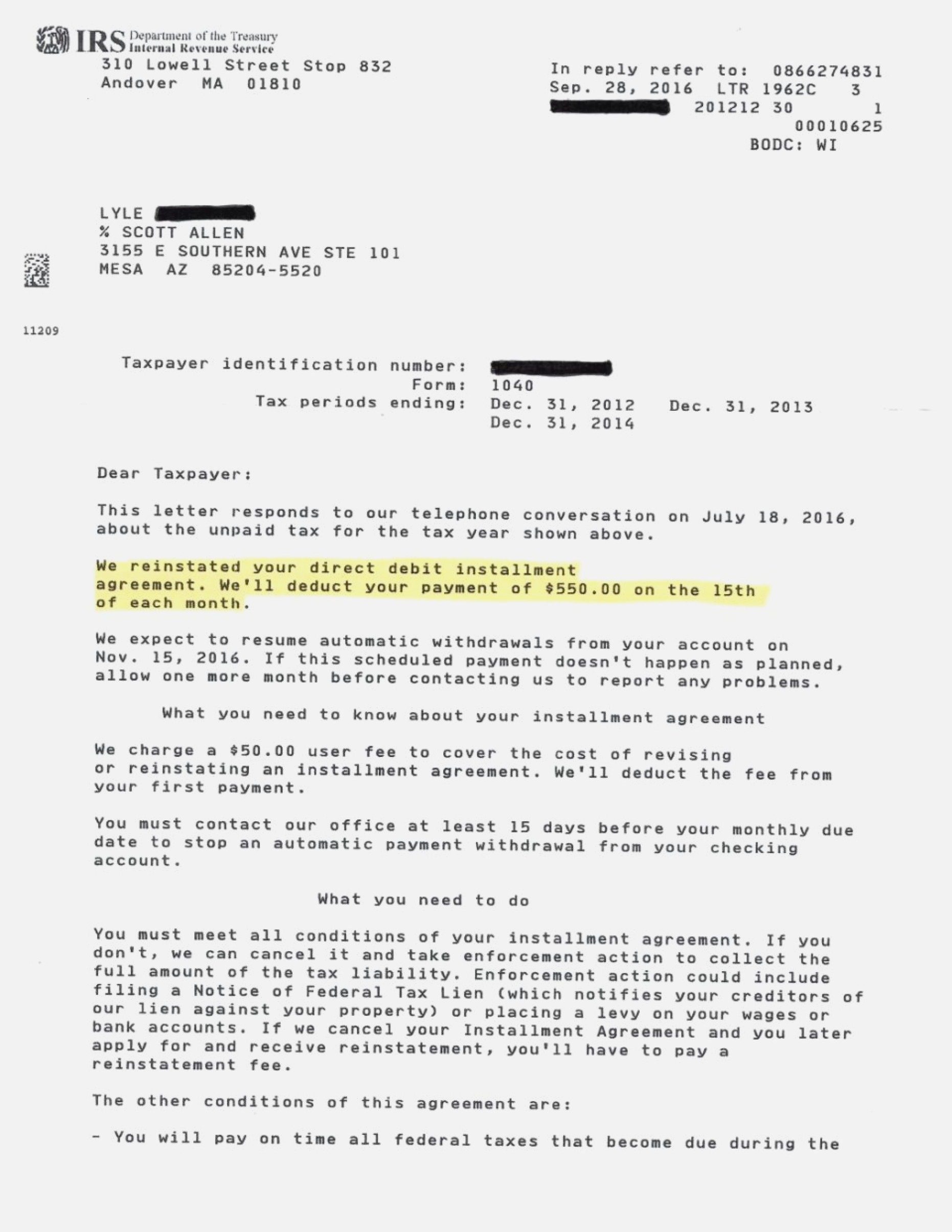

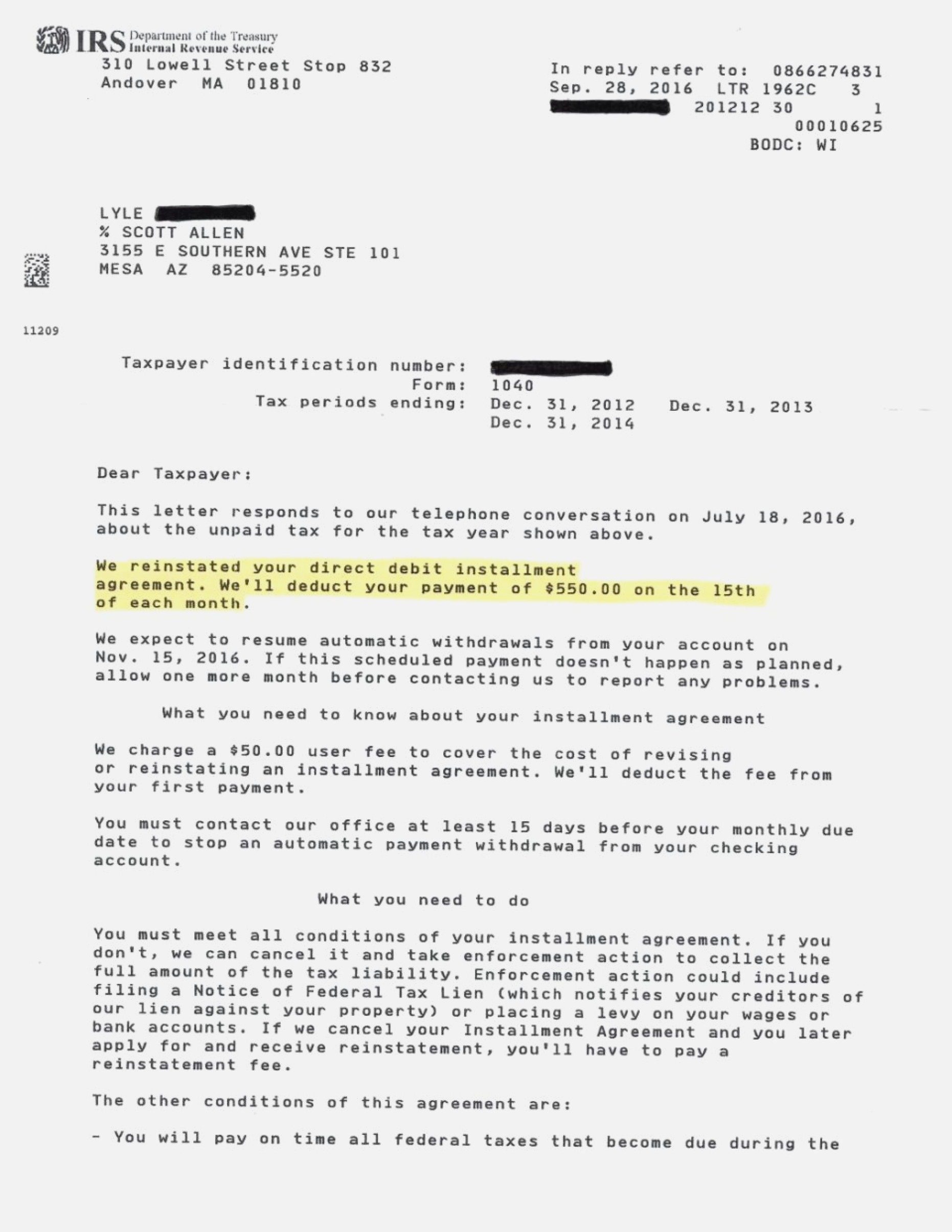

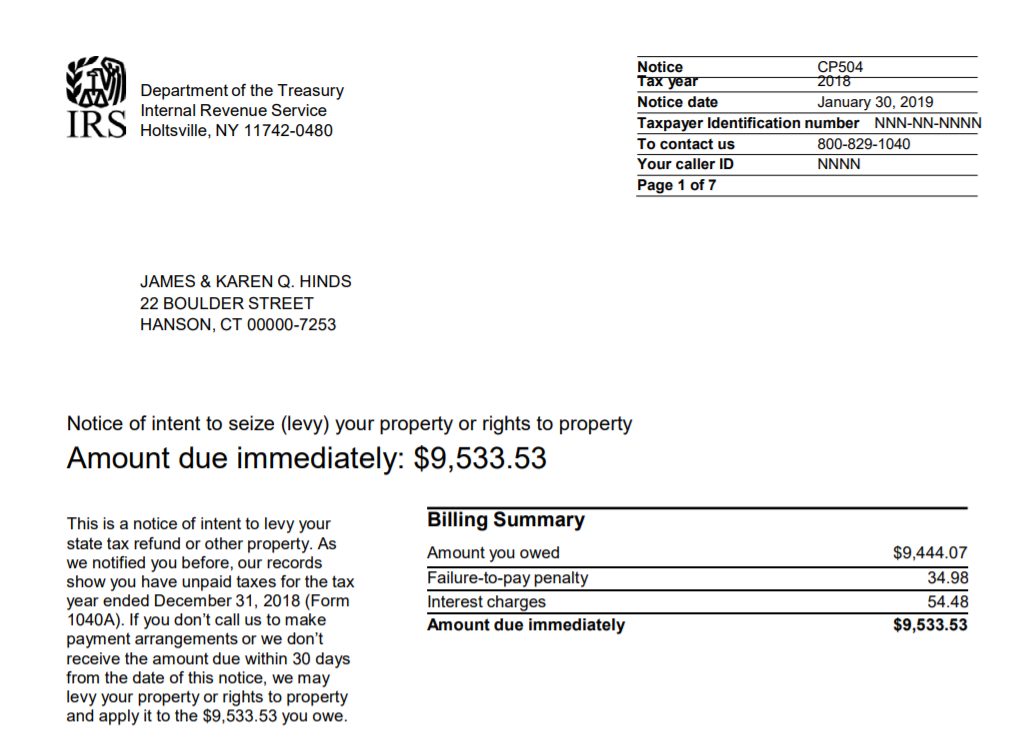

An IRS payment plan is an agreement that gives you an extended period of time to pay off the taxes you owe You ll avoid collection actions such as tax liens and tax levies by setting up a plan The IRS failure to pay penalty is 0 5 per month for each month you re late up to 25 of the amount you owe plus interest

Check money order or debit credit card Long term payment plan more than 180 days 50 000 in combined tax penalties and interest If you pay through automatic debit withdrawals 31 setup fee

Example Of Irs Payment Plan cover a large variety of printable, downloadable content that can be downloaded from the internet at no cost. They come in many forms, including worksheets, coloring pages, templates and more. The value of Example Of Irs Payment Plan is their flexibility and accessibility.

More of Example Of Irs Payment Plan

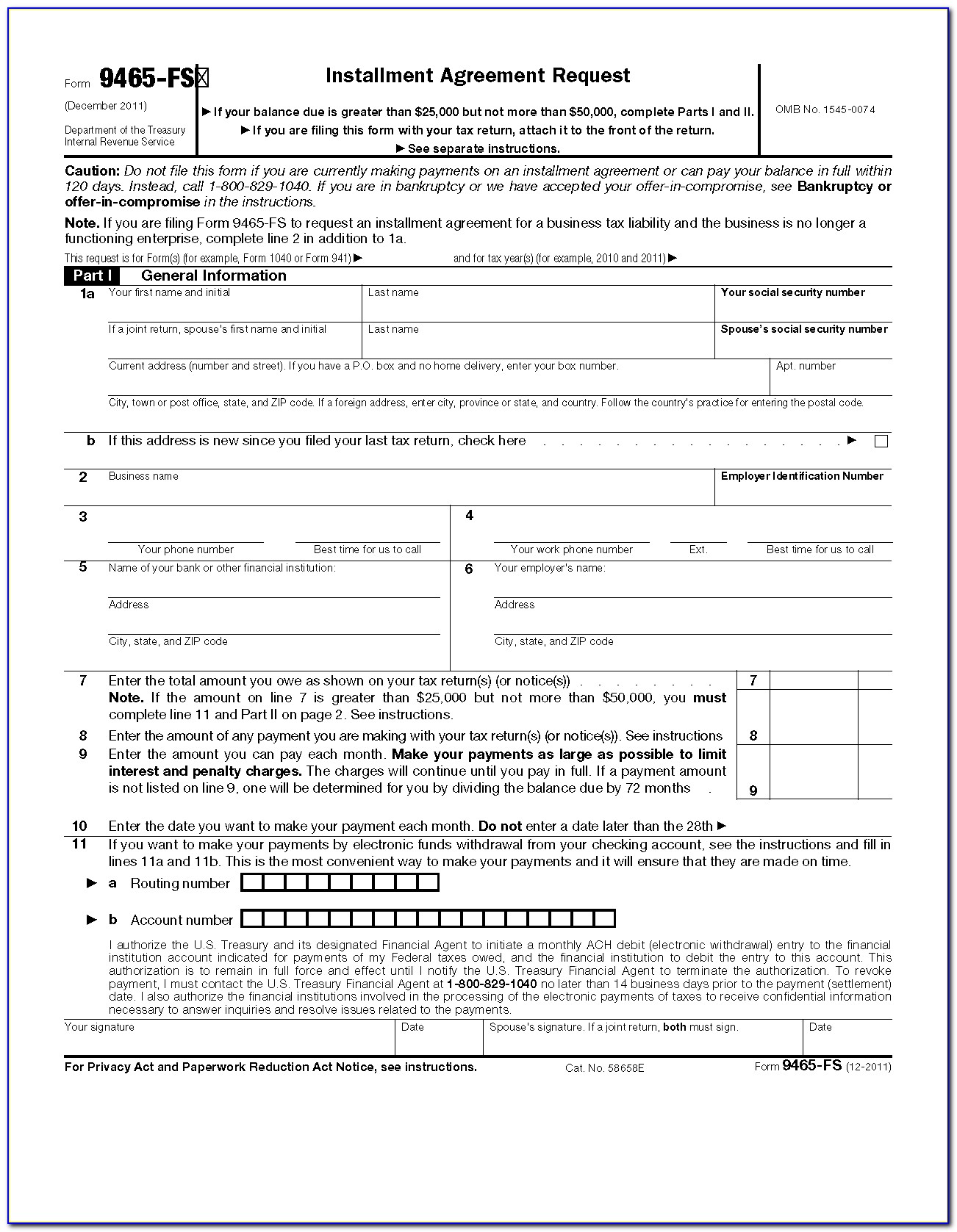

Irs Payment Plan Form 9465 Instructions Form Resume Examples

Irs Payment Plan Form 9465 Instructions Form Resume Examples

The simplest long term IRS payment plans to set up are The 36 month payment plan called a guaranteed installment agreement GIA For example you get up to 72 months to pay your tax bill in a SLIA or the collection statute expiration date whichever is shorter If your tax bill is more than 4 years old you should research your

Apply Online for a Payment Plan If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time Note Once you complete your online application you will receive immediate notification of whether your payment plan has

Example Of Irs Payment Plan have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: It is possible to tailor printed materials to meet your requirements in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes the perfect source for educators and parents.

-

It's easy: The instant accessibility to numerous designs and templates saves time and effort.

Where to Find more Example Of Irs Payment Plan

Types Of IRS Payment Programs Tax Law Advocates

Types Of IRS Payment Programs Tax Law Advocates

The IRS will look at your full financial situation to figure out your ability to pay The IRS will calculate your monthly payment based on your income and allowable expenses And you have to be able to pay your whole tax balance by the collection statute expiration date The IRS will file a tax lien for most of these agreements

There are two types of payment plans Short term payment plan The IRS offers additional time up to 180 days to pay in full It s not a formal payment option so there s no application and no fee but interest and any penalties continue to accrue until the tax debt is paid in full Long term payment plan Installment Agreement The IRS

Now that we've ignited your interest in Example Of Irs Payment Plan, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Example Of Irs Payment Plan designed for a variety applications.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Example Of Irs Payment Plan

Here are some ideas for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Example Of Irs Payment Plan are a treasure trove of practical and innovative resources catering to different needs and needs and. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of Example Of Irs Payment Plan and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can print and download these tools for free.

-

Do I have the right to use free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues in Example Of Irs Payment Plan?

- Certain printables might have limitations concerning their use. You should read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit a print shop in your area for superior prints.

-

What program will I need to access printables that are free?

- The majority of printables are in PDF format. They can be opened using free programs like Adobe Reader.

IRS Form For Payment Plan

IRS Letter 3338C Audit Reconsideration Acknowledgment H R Block

Check more sample of Example Of Irs Payment Plan below

New IRS Snail Mail SCAM Dfwci

38 pdf PAYMENT LETTER TO IRS PRINTABLE DOCX ZIP DOWNLOAD

IRS Letter 2272C Sample 1

IRS Audit Letter 2604C Sample 1

Irs Payment Plan Letter Everything You Need To Know About An Irs

IRS Letter 5071C Sample 1 Irs Taxes Irs Lettering

https://www.nerdwallet.com/article/taxes/how-to-set-up-irs-payment-plan

Check money order or debit credit card Long term payment plan more than 180 days 50 000 in combined tax penalties and interest If you pay through automatic debit withdrawals 31 setup fee

https://www.irs.gov/newsroom/irs-payment-plan...

Individual taxpayers online payment plan options include Short term payment plans For taxpayers who have a total balance less than 100 000 in combined tax penalties and interest This plan gives them an extra 180 days to pay the balance in full Long term payment plan also called an installment agreement For taxpayers who

Check money order or debit credit card Long term payment plan more than 180 days 50 000 in combined tax penalties and interest If you pay through automatic debit withdrawals 31 setup fee

Individual taxpayers online payment plan options include Short term payment plans For taxpayers who have a total balance less than 100 000 in combined tax penalties and interest This plan gives them an extra 180 days to pay the balance in full Long term payment plan also called an installment agreement For taxpayers who

IRS Audit Letter 2604C Sample 1

38 pdf PAYMENT LETTER TO IRS PRINTABLE DOCX ZIP DOWNLOAD

Irs Payment Plan Letter Everything You Need To Know About An Irs

IRS Letter 5071C Sample 1 Irs Taxes Irs Lettering

How To Get On An IRS Payment Plan GOBankingRates

32 Exclusive Image Of Irs Installment Agreement Online Letterify info

32 Exclusive Image Of Irs Installment Agreement Online Letterify info

IRS Demand Letters What Are They And What You Need To Know