In the age of digital, where screens rule our lives however, the attraction of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or simply to add the personal touch to your space, How Do I Account For A Lease Under Asc 842 are now an essential resource. With this guide, you'll dive into the world of "How Do I Account For A Lease Under Asc 842," exploring their purpose, where to find them and how they can add value to various aspects of your life.

Get Latest How Do I Account For A Lease Under Asc 842 Below

How Do I Account For A Lease Under Asc 842

How Do I Account For A Lease Under Asc 842 -

Download the entire accounting for leases under ASC 842 Blueprint Series Accounting for leases can be complex especially when you have to manage new regulations Read

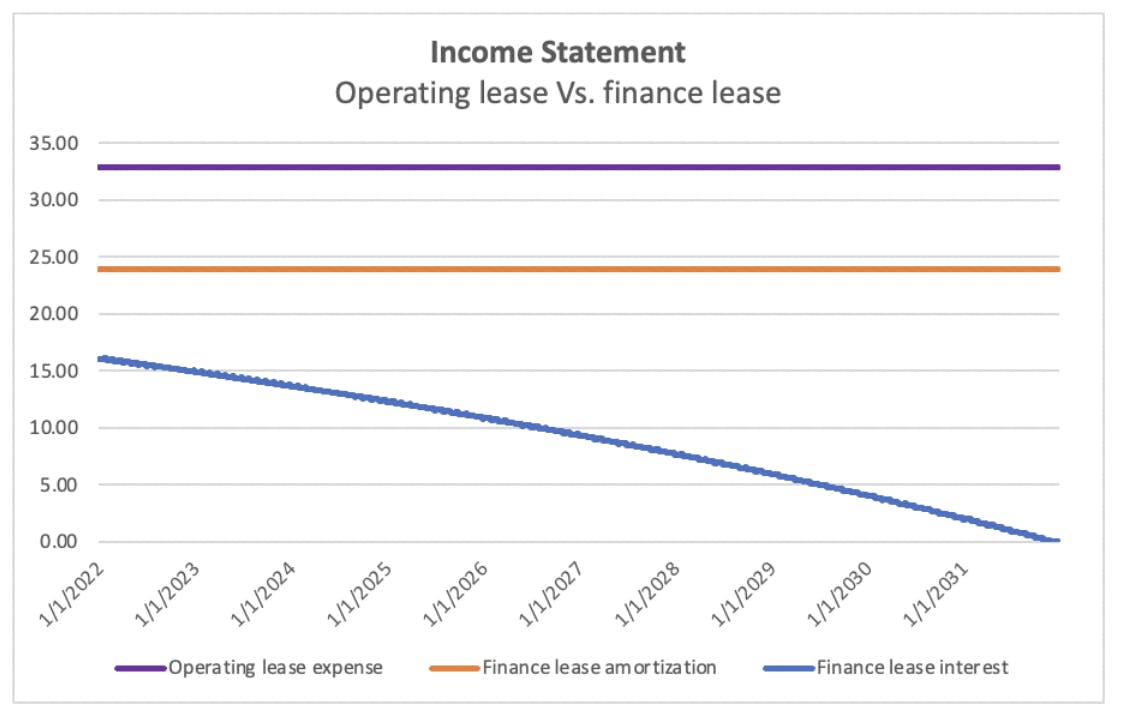

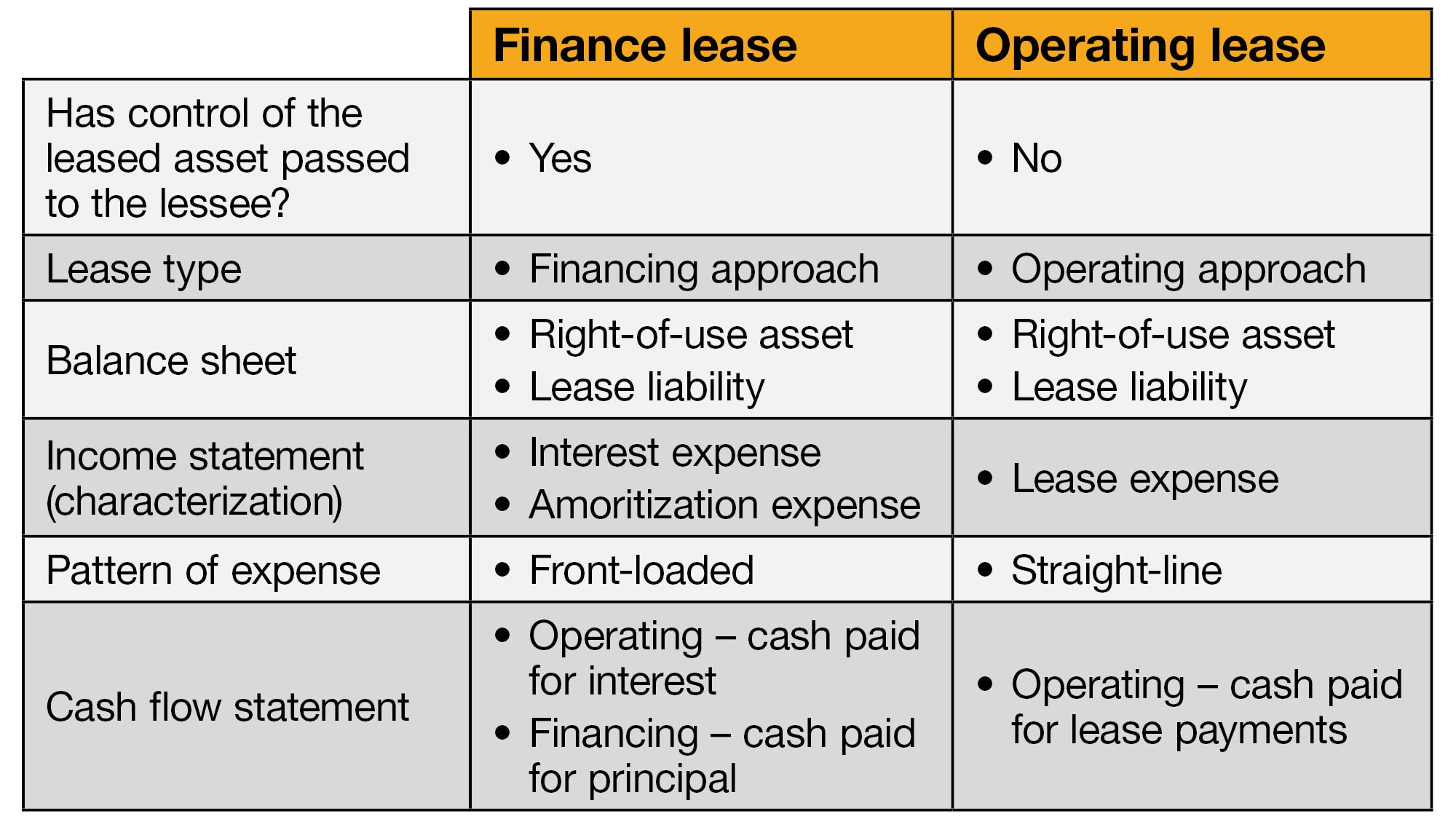

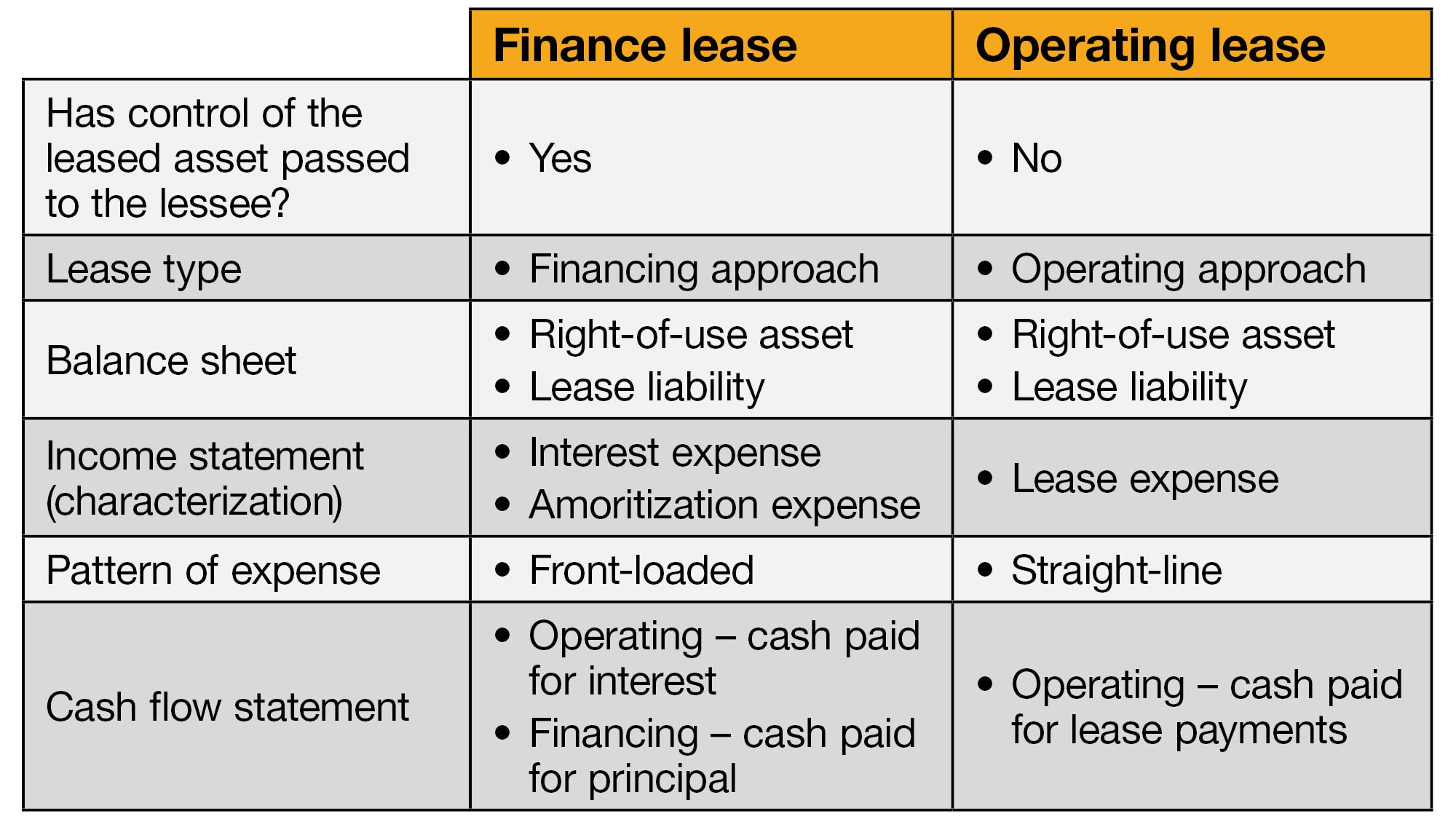

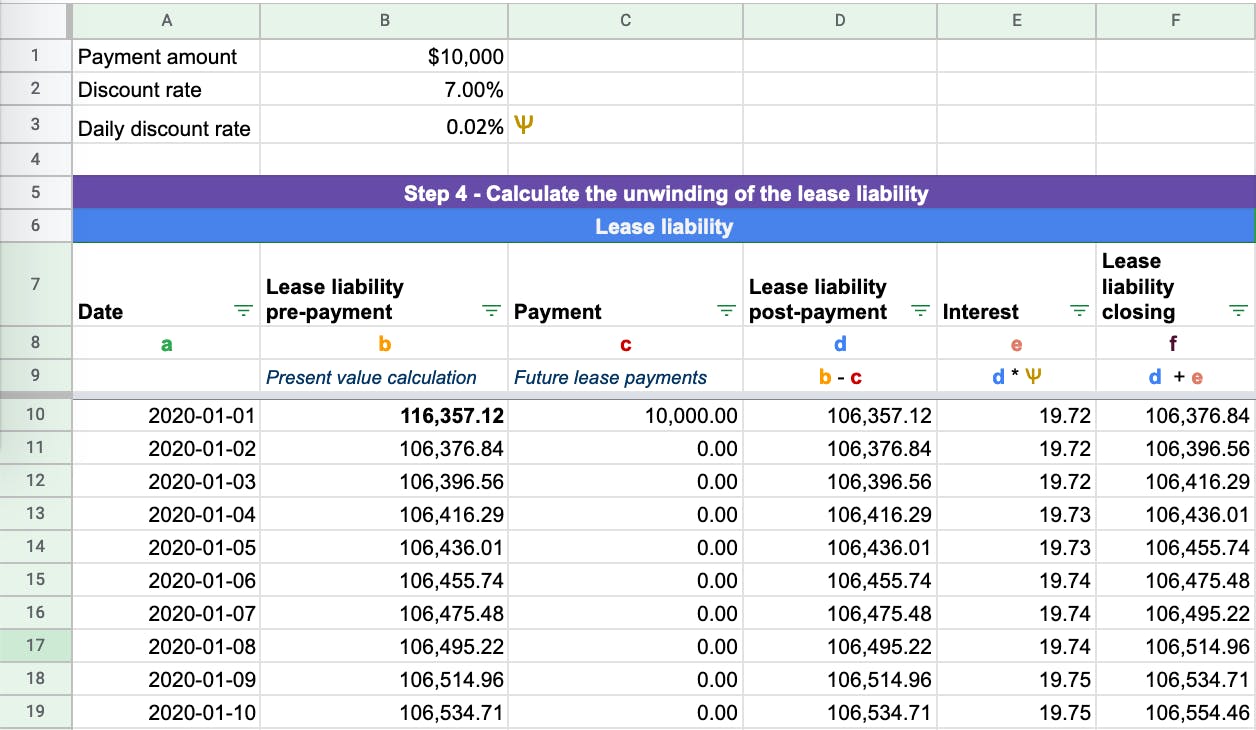

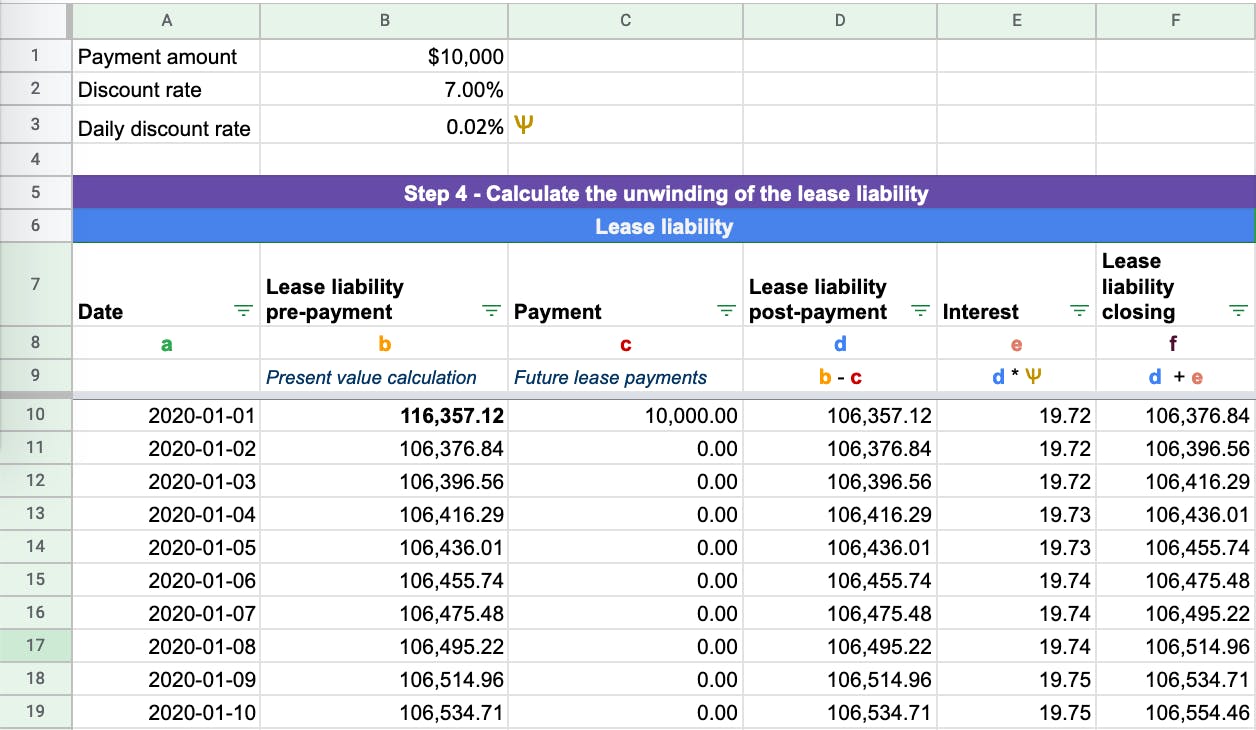

Lessee accounting ASC 842 requires a lessee to classify a lease as either a finance or operating lease Interest and amortization expense are recognized for finance leases

How Do I Account For A Lease Under Asc 842 provide a diverse selection of printable and downloadable materials available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and more. The value of How Do I Account For A Lease Under Asc 842 is in their versatility and accessibility.

More of How Do I Account For A Lease Under Asc 842

How To Calculate The Right Of Use Asset Amortization And Lease Expense

How To Calculate The Right Of Use Asset Amortization And Lease Expense

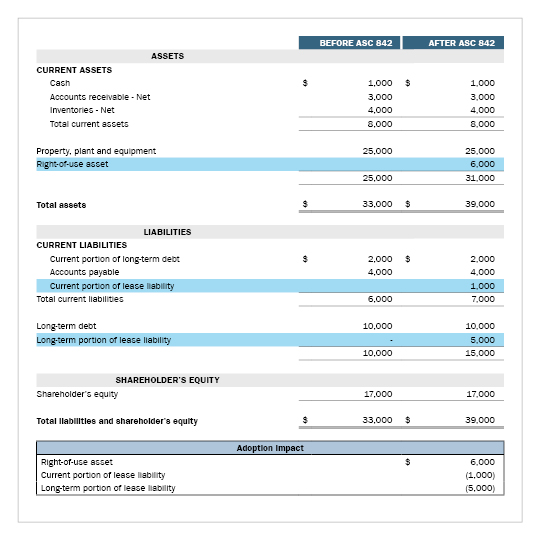

The first step to complying with ASC 842 is to pin down and include agreements that now count as leases under the new standard With the exception of certain short term

Under the new lease accounting standard ASC 842 the lease is either an operating lease or a finance lease A finance lease supersedes a capital lease under ASC 840 Unlike operating leases under ASC 842

How Do I Account For A Lease Under Asc 842 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printables to your specific needs whether it's making invitations as well as organizing your calendar, or even decorating your home.

-

Educational Impact: These How Do I Account For A Lease Under Asc 842 cater to learners from all ages, making the perfect tool for parents and educators.

-

An easy way to access HTML0: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more How Do I Account For A Lease Under Asc 842

5 Steps To ASC 842 Lease Compliance EZLease

5 Steps To ASC 842 Lease Compliance EZLease

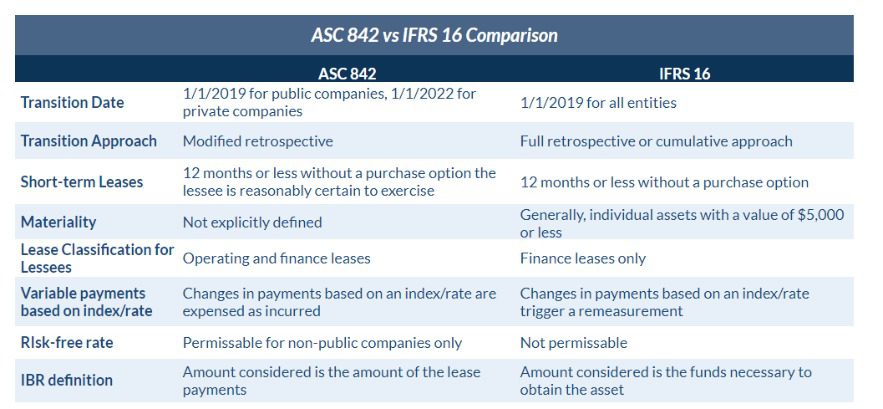

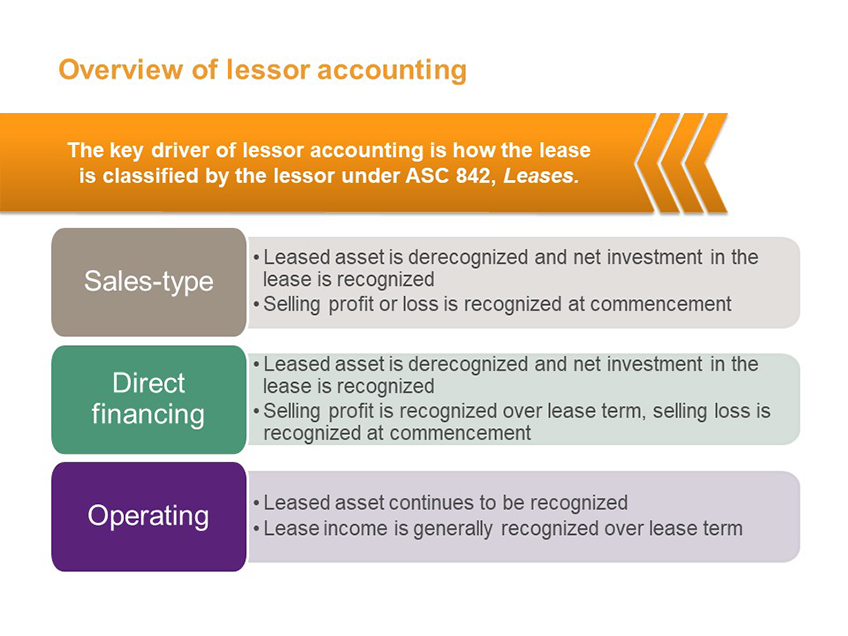

We unpack hot topics in lease accounting under ASC 842 and considerations for entities that haven t yet adopted the new standard Deloitte s lease accounting guide examines how ASC 842 adoption will

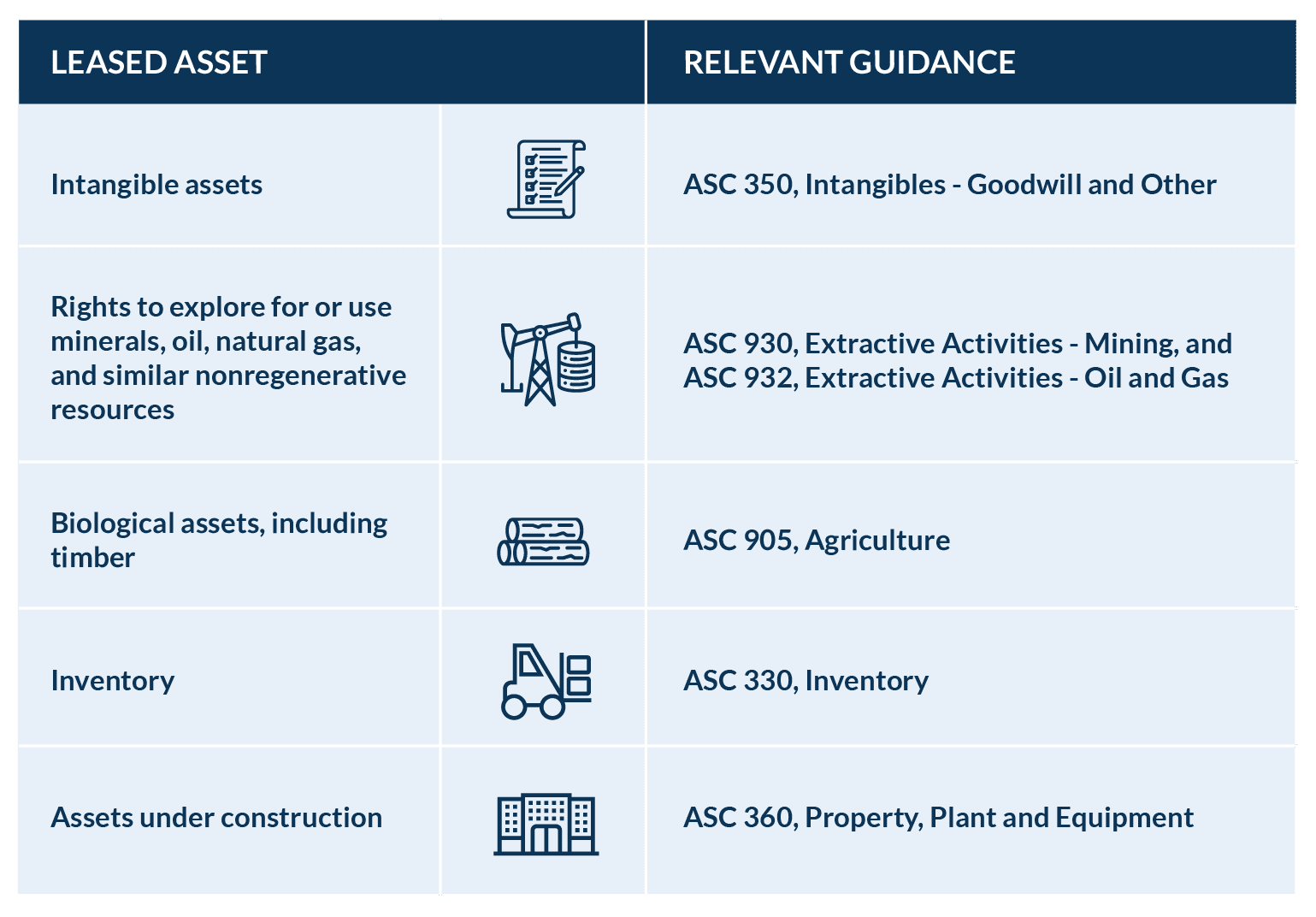

ASC 842 subtopics Lease types in scope ASC 842 is made up of five subtopics an overview and four sections covering the following transaction types

We hope we've stimulated your interest in How Do I Account For A Lease Under Asc 842 We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of How Do I Account For A Lease Under Asc 842 to suit a variety of motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing How Do I Account For A Lease Under Asc 842

Here are some unique ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

How Do I Account For A Lease Under Asc 842 are an abundance of creative and practical resources catering to different needs and passions. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the many options of How Do I Account For A Lease Under Asc 842 to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these documents for free.

-

Can I make use of free templates for commercial use?

- It is contingent on the specific conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright problems with How Do I Account For A Lease Under Asc 842?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and conditions set forth by the creator.

-

How can I print How Do I Account For A Lease Under Asc 842?

- You can print them at home using any printer or head to any local print store for the highest quality prints.

-

What program will I need to access printables that are free?

- The majority of printed documents are in the format of PDF, which can be opened with free programs like Adobe Reader.

How To Account For Lease Modifications Under ASC 842 Occupier

What Is The Commencement Date Of A Lease Under ASC 842 And IFRS 16

Check more sample of How Do I Account For A Lease Under Asc 842 below

How The New Lease Standard Could Impact Your Compliance With 4 Common

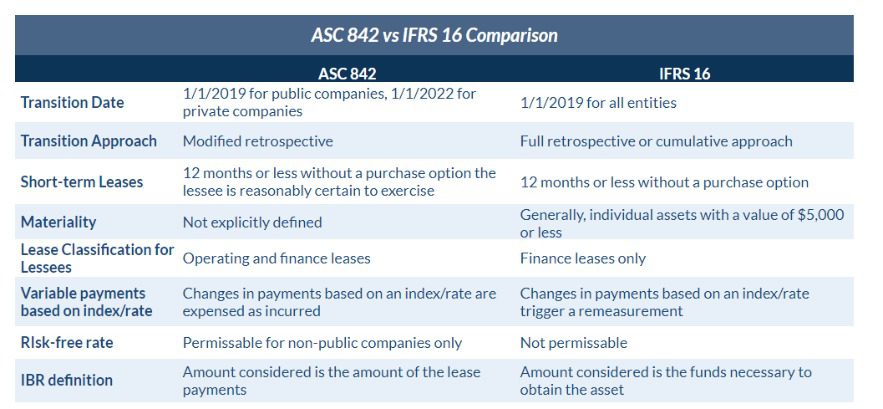

IFRS 16 Vs ASC 842 US GAAP Lease Accounting Differences

How To Conduct An Inventory Of Your Leases

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

Tasked With An ASC 842 Adoption Let s Start With The Basics National

Asc 842 Lease Accounting Template

https://viewpoint.pwc.com/.../pwcleasesguide0124.pdf

Lessee accounting ASC 842 requires a lessee to classify a lease as either a finance or operating lease Interest and amortization expense are recognized for finance leases

https://viewpoint.pwc.com/dt/us/en/pwc/accounting...

View image A lessee should account for any direct costs lease incentives or other payments made by the lessee or lessor in connection with a lease modification in the

Lessee accounting ASC 842 requires a lessee to classify a lease as either a finance or operating lease Interest and amortization expense are recognized for finance leases

View image A lessee should account for any direct costs lease incentives or other payments made by the lessee or lessor in connection with a lease modification in the

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

IFRS 16 Vs ASC 842 US GAAP Lease Accounting Differences

Tasked With An ASC 842 Adoption Let s Start With The Basics National

Asc 842 Lease Accounting Template

Planet Jack Jumping Formal Right Of Use Asset Calculation Terorist

Asc 842 Lease Accounting Template

Asc 842 Lease Accounting Template

Lease Accounting An Overview Of ASC 842 GAAP Dynamics