In this day and age where screens rule our lives but the value of tangible printed materials isn't diminishing. Whatever the reason, whether for education such as creative projects or simply to add some personal flair to your space, How Do You Account For Leased Assets are now an essential resource. With this guide, you'll take a dive deeper into "How Do You Account For Leased Assets," exploring what they are, where to find them, and what they can do to improve different aspects of your life.

Get Latest How Do You Account For Leased Assets Below

How Do You Account For Leased Assets

How Do You Account For Leased Assets -

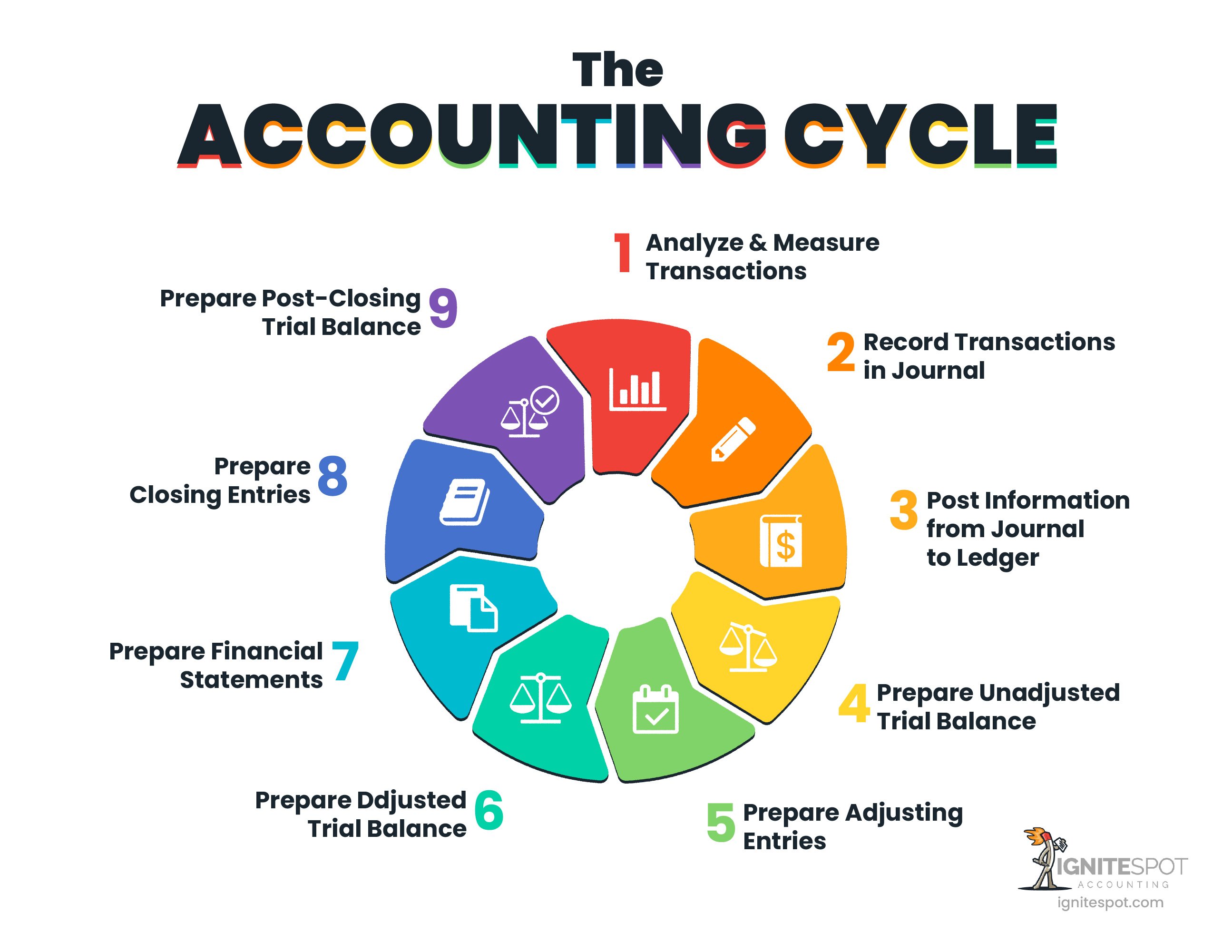

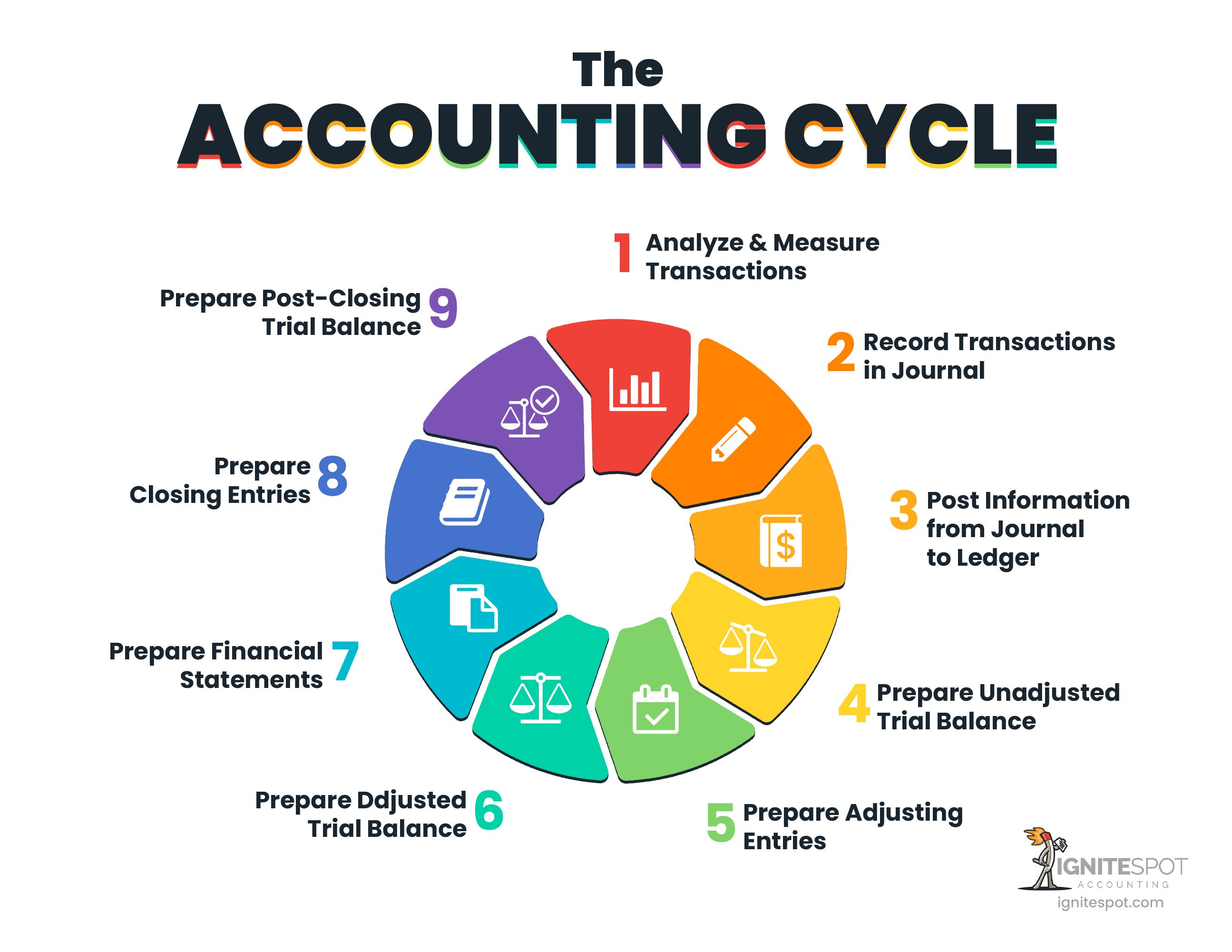

In order to record the lease liability on the balance sheet we need to know these 3 factors Determine the lease term Determining the lease term sometimes requires judgment particularly when we have renewal and termination options as part of the lease agreement Verify the lease payment

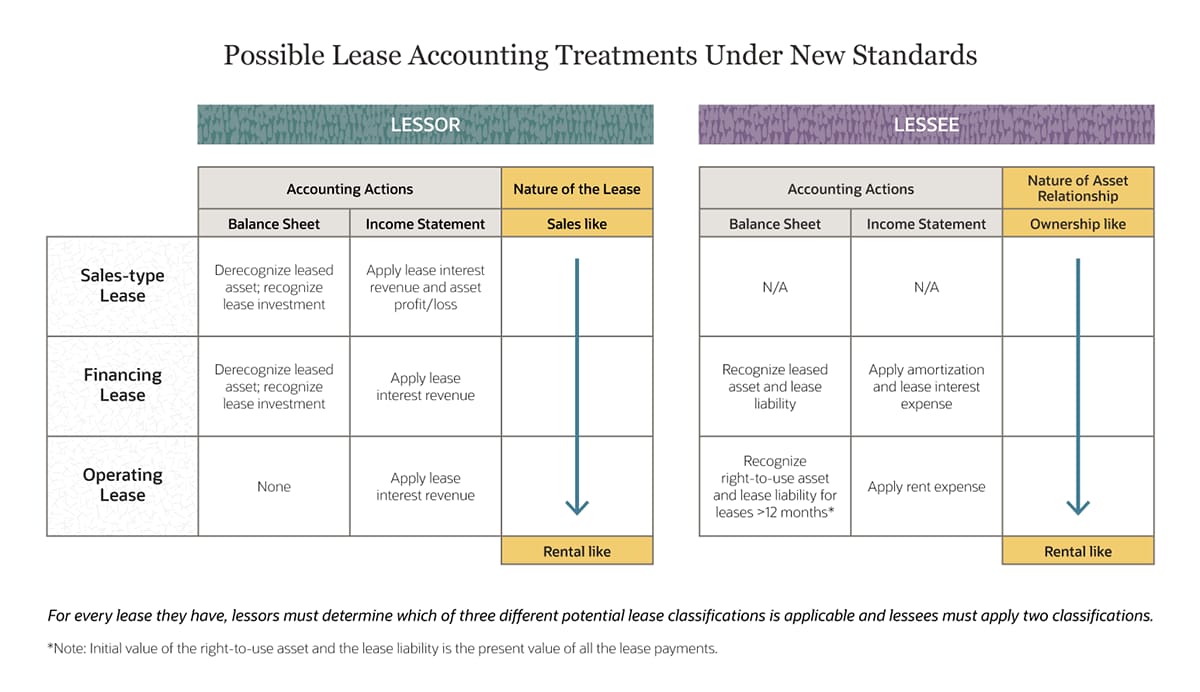

Accounting for leases Relevant to ACCA Qualification Paper F7 The accounting topic of leases is a popular Paper F7 exam area that could feature to varying degrees in Questions 2 3 4 or 5 of the exam This topic area is currently covered by IAS 17 Leases

How Do You Account For Leased Assets include a broad array of printable content that can be downloaded from the internet at no cost. They come in many styles, from worksheets to templates, coloring pages, and more. The value of How Do You Account For Leased Assets is their versatility and accessibility.

More of How Do You Account For Leased Assets

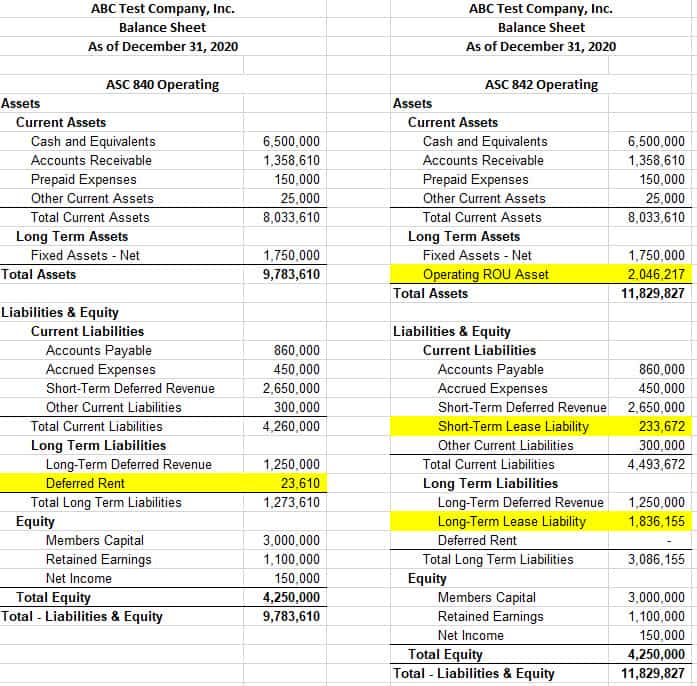

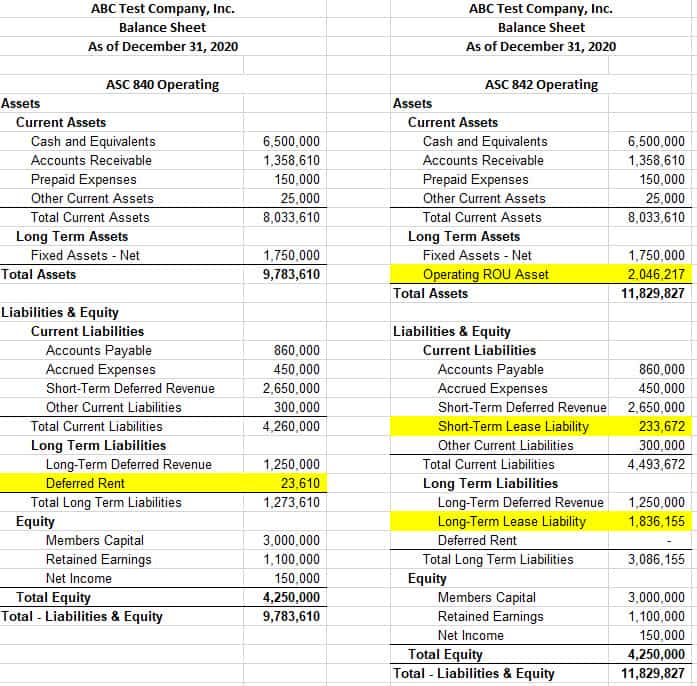

Accounting For Operating Leases The CPA Journal

Accounting For Operating Leases The CPA Journal

Step 1 Collect input data Find the operating lease expenses operating income reported debt cost of debt and reported interest expenses

Lease accounting is the process by which a company records the financial impacts of its leasing activities Leases that meet specific classification requirements must be recorded on a company s financial statements Here s

How Do You Account For Leased Assets have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: You can tailor the design to meet your needs for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Impact: The free educational worksheets can be used by students of all ages, making them a great source for educators and parents.

-

Easy to use: Quick access to the vast array of design and templates is time-saving and saves effort.

Where to Find more How Do You Account For Leased Assets

Business Tax Finance Equation Accountants

Business Tax Finance Equation Accountants

The new lease accounting standard recently became effective for private companies Here are 10 answers to many questions being asked about ROU assets

Capital lease accounting relates to the treatment of assets taken on lease by a business under a capital lease agreement with a lessor In a capital lease the asset s taken on the lease is recorded as an asset on the balance sheet

We've now piqued your interest in printables for free Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of How Do You Account For Leased Assets to suit a variety of goals.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing How Do You Account For Leased Assets

Here are some unique ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How Do You Account For Leased Assets are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the wide world of How Do You Account For Leased Assets today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables for commercial purposes?

- It's determined by the specific terms of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with How Do You Account For Leased Assets?

- Certain printables could be restricted on usage. You should read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home using the printer, or go to the local print shops for the highest quality prints.

-

What software do I need to run How Do You Account For Leased Assets?

- Most PDF-based printables are available in the format PDF. This is open with no cost software, such as Adobe Reader.

SOLVED Benzene Has An Ultraviolet Absorption At lambda max 204

Why Use LeaseQuery As An Integration Polaris Business Solutions

Check more sample of How Do You Account For Leased Assets below

What Is Lease Accounting Expert Guide Examples NetSuite

Fixed Assets List

How Do You Account For Liabilities

12 Column Account Book Ledger Book Accounting Ledger Notebook 12 Column

Pasivos Por Arrendamiento El Verdadero Impacto En El Balance Market Tay

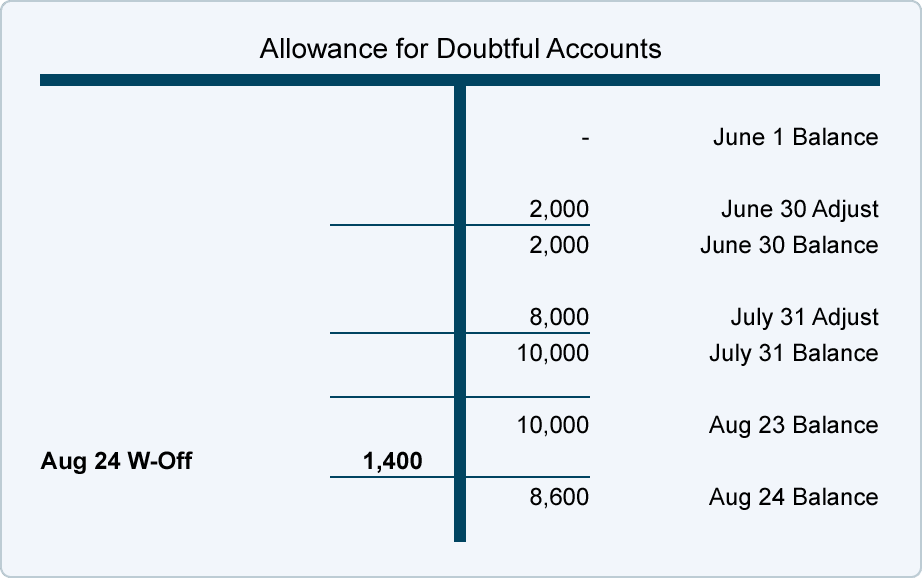

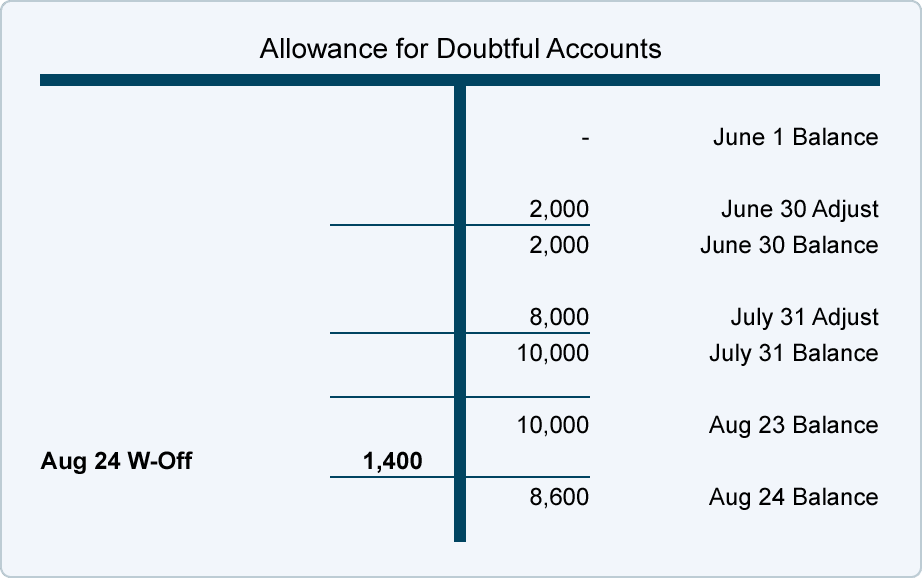

What Is The Allowance Method Online Accounting

https://www.accaglobal.com/uk/en/student/exam...

Accounting for leases Relevant to ACCA Qualification Paper F7 The accounting topic of leases is a popular Paper F7 exam area that could feature to varying degrees in Questions 2 3 4 or 5 of the exam This topic area is currently covered by IAS 17 Leases

https://www.netsuite.com/.../lease-accounting.shtml

In an operating lease the lessee records a right of use asset and a lease liability on their balance sheet A right of use asset designation distinguishes leased assets from a company owned assets which is especially relevant for financial reporting purposes

Accounting for leases Relevant to ACCA Qualification Paper F7 The accounting topic of leases is a popular Paper F7 exam area that could feature to varying degrees in Questions 2 3 4 or 5 of the exam This topic area is currently covered by IAS 17 Leases

In an operating lease the lessee records a right of use asset and a lease liability on their balance sheet A right of use asset designation distinguishes leased assets from a company owned assets which is especially relevant for financial reporting purposes

12 Column Account Book Ledger Book Accounting Ledger Notebook 12 Column

Fixed Assets List

Pasivos Por Arrendamiento El Verdadero Impacto En El Balance Market Tay

What Is The Allowance Method Online Accounting

Got A Holiday Bonus And Want To Start Investing Retirely

Operating Lease Vs Finance Lease Journal Entries

Operating Lease Vs Finance Lease Journal Entries

Planet Jack Jumping Formal Right Of Use Asset Calculation Terorist