Today, when screens dominate our lives, the charm of tangible printed materials isn't diminishing. Whether it's for educational purposes, creative projects, or just adding an extra personal touch to your area, How Much Medical Expense Can You Claim On Your Taxes have proven to be a valuable resource. In this article, we'll take a dive in the world of "How Much Medical Expense Can You Claim On Your Taxes," exploring what they are, how they can be found, and what they can do to improve different aspects of your lives.

Get Latest How Much Medical Expense Can You Claim On Your Taxes Below

How Much Medical Expense Can You Claim On Your Taxes

How Much Medical Expense Can You Claim On Your Taxes -

Learn how to deduct medical and dental expenses on Schedule A Form 1040 for 2023 tax returns Find out what expenses are includible how to treat reimbursements and what to do if you sell

Learn how to claim medical expense deductions on your 2023 tax return by itemizing on Schedule A Find out which expenses qualify and how to calculate your deduction threshold based on your

How Much Medical Expense Can You Claim On Your Taxes cover a large assortment of printable, downloadable materials that are accessible online for free cost. They come in many formats, such as worksheets, templates, coloring pages, and many more. The benefit of How Much Medical Expense Can You Claim On Your Taxes lies in their versatility and accessibility.

More of How Much Medical Expense Can You Claim On Your Taxes

What Non work Expenses Can You Claim On Your Tax Return

What Non work Expenses Can You Claim On Your Tax Return

Learn how to calculate and take your medical expense deduction on your taxes and what expenses qualify and don t qualify The deduction threshold is 7 5 of your adjusted gross income and you need to itemize

Find out if you can claim your medical and dental expenses as a tax deduction Answer questions about your filing status expenses income

How Much Medical Expense Can You Claim On Your Taxes have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor the templates to meet your individual needs be it designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages, making them a vital tool for parents and educators.

-

The convenience of Quick access to the vast array of design and templates will save you time and effort.

Where to Find more How Much Medical Expense Can You Claim On Your Taxes

Save Time And Money On Expense Claim And Yardi Paperwork

Save Time And Money On Expense Claim And Yardi Paperwork

Learn how to claim a medical expense deduction on your taxes if you itemize and exceed 7 5 of your adjusted gross income Find out what expenses are

Learn how to deduct medical expenses from your taxes if they exceed 7 5 percent of your AGI and you itemize your deductions Find out which medical costs are tax deductible and which are not

In the event that we've stirred your curiosity about How Much Medical Expense Can You Claim On Your Taxes Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with How Much Medical Expense Can You Claim On Your Taxes for all goals.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to planning a party.

Maximizing How Much Medical Expense Can You Claim On Your Taxes

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets for teaching at-home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

How Much Medical Expense Can You Claim On Your Taxes are an abundance of fun and practical tools catering to different needs and interest. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the wide world of How Much Medical Expense Can You Claim On Your Taxes today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes you can! You can download and print these free resources for no cost.

-

Does it allow me to use free printables for commercial use?

- It's based on the conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may come with restrictions regarding their use. Make sure you read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase premium prints.

-

What program will I need to access printables free of charge?

- The majority of printables are as PDF files, which is open with no cost software like Adobe Reader.

How Much Can You Claim On Your 2019 Return Paris Financial

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Check more sample of How Much Medical Expense Can You Claim On Your Taxes below

Can I Claim Medical Expenses On My Taxes TMD Accounting

How To Claim Self Employed Expenses Self Bookkeeping Business Self

How Does The Medical Expense Tax Credit Work In Canada

Mileage Claim Form Template

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

What Deductions Can You Claim On Your Website Abacus Professional

https://turbotax.intuit.com › tax-tips › h…

Learn how to claim medical expense deductions on your 2023 tax return by itemizing on Schedule A Find out which expenses qualify and how to calculate your deduction threshold based on your

https://www.thebalancemoney.com

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Learn how to claim medical expense deductions on your 2023 tax return by itemizing on Schedule A Find out which expenses qualify and how to calculate your deduction threshold based on your

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Mileage Claim Form Template

How To Claim Self Employed Expenses Self Bookkeeping Business Self

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

What Deductions Can You Claim On Your Website Abacus Professional

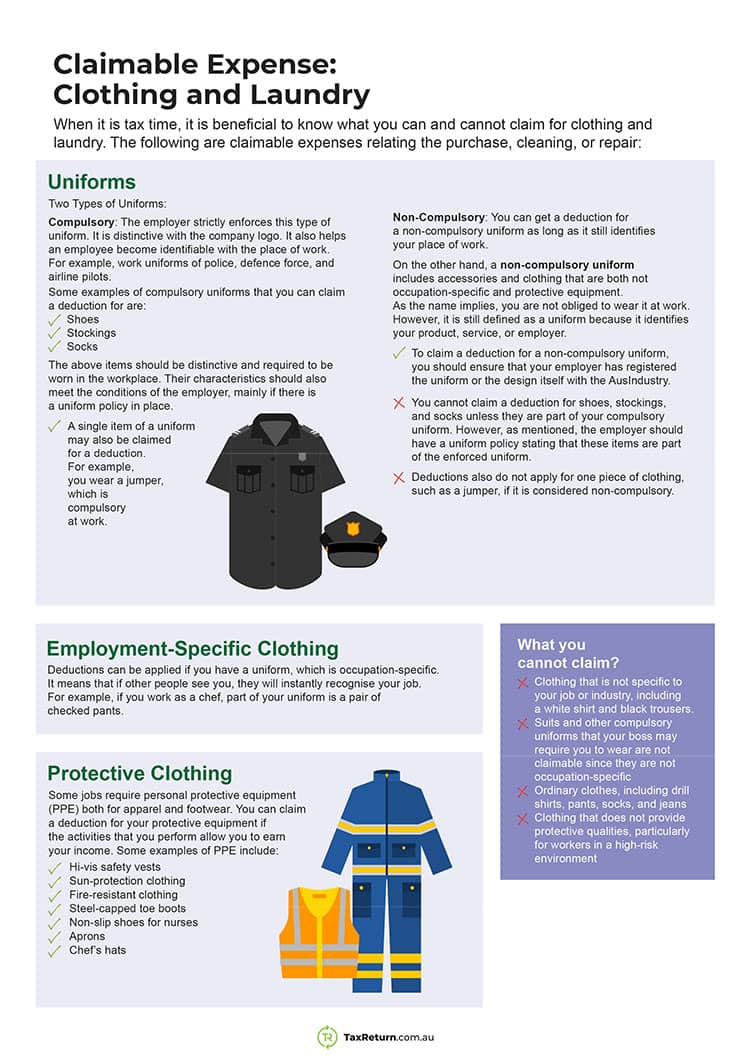

Claimable Expenses What You Can Claim On Your Tax Return

Deductions To Claim On Your Tax Return Affordable Bookkeeping Payroll

Deductions To Claim On Your Tax Return Affordable Bookkeeping Payroll

7 Tax Deductions You Shouldn t Miss