In this age of electronic devices, where screens rule our lives and the appeal of physical printed products hasn't decreased. Whatever the reason, whether for education project ideas, artistic or just adding some personal flair to your home, printables for free have proven to be a valuable resource. Through this post, we'll take a dive into the world "How Much Tax Back Do You Get For Medical Expenses," exploring the different types of printables, where they are, and how they can enhance various aspects of your life.

Get Latest How Much Tax Back Do You Get For Medical Expenses Below

How Much Tax Back Do You Get For Medical Expenses

How Much Tax Back Do You Get For Medical Expenses -

So if your AGI is 50 000 and your total medical expenses are 5 000 you can deduct 2 500 the amount which exceeds 7 5 of 50 000 What qualifies as a qualified medical expense There are a few different types of medical expense tax deductions that may be tax deductible

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

How Much Tax Back Do You Get For Medical Expenses cover a large collection of printable material that is available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of How Much Tax Back Do You Get For Medical Expenses

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

TurboTax helps you understand medical expense deductions HSA and MSA distributions flexible spending accounts IRA and 401 k payouts for medical expenses and more File 100 FREE with expert help 37 of filers qualify

If you spent 9 000 on deductible medical expenses 2 000 could be deducted since that s the difference left over after subtracting 7 000 Medical Expense Threshold A tax bill temporarily lowered the medical expense threshold from 10 percent to 7 5 percent of your annual income only for 2017 and 2018

How Much Tax Back Do You Get For Medical Expenses have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Use: Printables for education that are free provide for students of all ages, which makes them a valuable device for teachers and parents.

-

Easy to use: Access to the vast array of design and templates helps save time and effort.

Where to Find more How Much Tax Back Do You Get For Medical Expenses

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

Single or married filing separately 13 850 15 350 if they re at least 65 Married filing jointly or qualifying widow er 27 700 Head of household 20 800 If the value of your total itemized deductions would exceed your standard deduction you ll need to complete a and detail every deduction in an itemized list

The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little complicated

Now that we've piqued your interest in How Much Tax Back Do You Get For Medical Expenses, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of How Much Tax Back Do You Get For Medical Expenses designed for a variety objectives.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast array of topics, ranging all the way from DIY projects to planning a party.

Maximizing How Much Tax Back Do You Get For Medical Expenses

Here are some inventive ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How Much Tax Back Do You Get For Medical Expenses are a treasure trove of practical and imaginative resources catering to different needs and interest. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the world of How Much Tax Back Do You Get For Medical Expenses today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Tax Back Do You Get For Medical Expenses truly are they free?

- Yes they are! You can print and download these tools for free.

-

Are there any free printing templates for commercial purposes?

- It's based on the terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with How Much Tax Back Do You Get For Medical Expenses?

- Some printables may come with restrictions on their use. Be sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for high-quality prints.

-

What software do I require to open printables for free?

- Most PDF-based printables are available in the format PDF. This can be opened using free software like Adobe Reader.

How Much Does The Average American Pay In Taxes It Depends

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

Check more sample of How Much Tax Back Do You Get For Medical Expenses below

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

How Does The Medical Expense Tax Credit Work In Canada

The Retirement Rules For Foreign Service Federal Employees

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

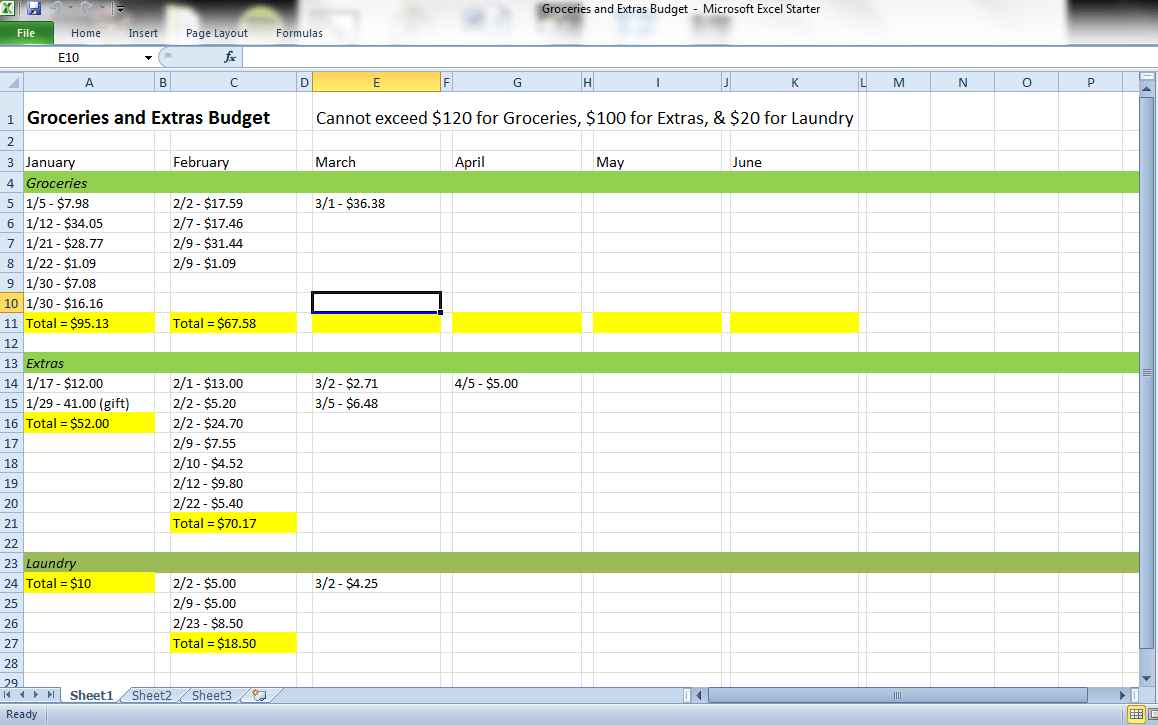

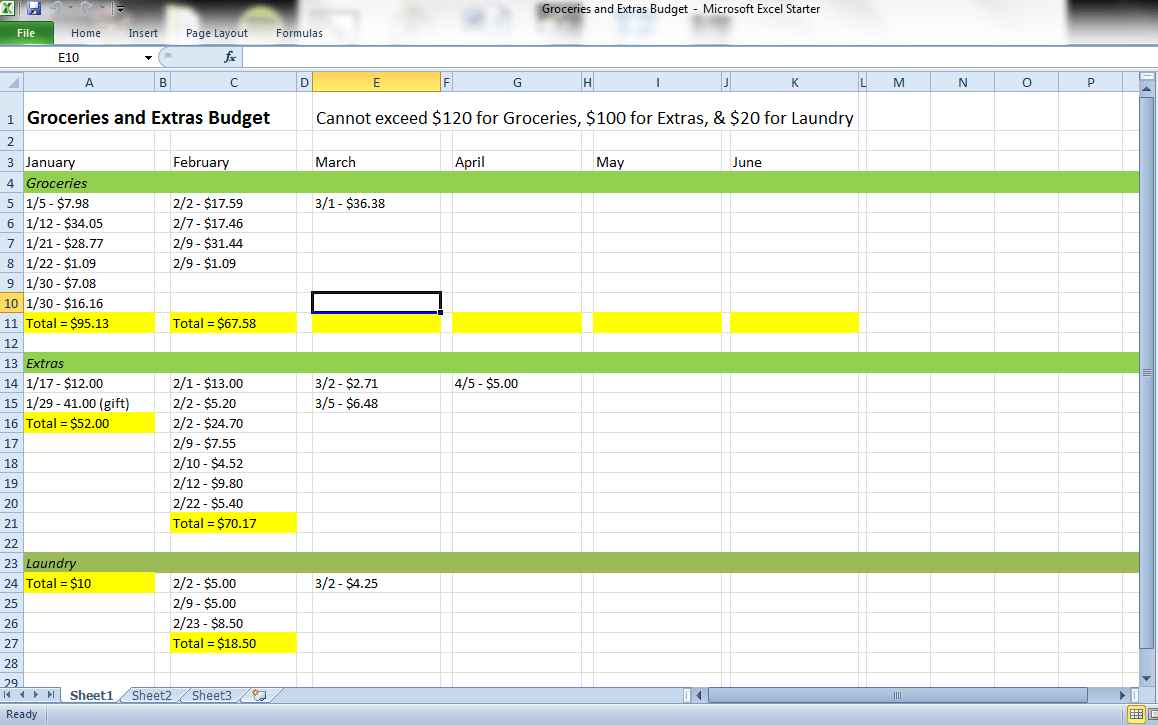

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

Here s The Average IRS Tax Refund Amount By State GOBankingRates

https://www.nerdwallet.com/article/taxes/medical-expense-tax-deduction

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

https://pocketsense.com/figure-much-back-medical...

How to Figure Out How Much You Get Back Suppose you have an AGI of 80 000 and incurred huge medical expenses of 30 000 for the tax year 2021 Based on the 7 5 percent IRS rule you can only deduct expenses in excess of 6 000 Therefore you can deduct 30 000 6 000 which equals 24 000

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

How to Figure Out How Much You Get Back Suppose you have an AGI of 80 000 and incurred huge medical expenses of 30 000 for the tax year 2021 Based on the 7 5 percent IRS rule you can only deduct expenses in excess of 6 000 Therefore you can deduct 30 000 6 000 which equals 24 000

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

How Does The Medical Expense Tax Credit Work In Canada

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

Can You Claim A Tax Deduction For Medical Expenses OVLG

Can You Claim A Tax Deduction For Medical Expenses OVLG

JMC s EURO VO RETREATS EXTRAVAGANT OR PRICELESS Nethervoice