Today, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons or creative projects, or simply to add an extra personal touch to your home, printables for free are now a vital source. In this article, we'll take a dive in the world of "Original Cost Method In Depreciation," exploring the different types of printables, where you can find them, and how they can add value to various aspects of your life.

What Are Original Cost Method In Depreciation?

Original Cost Method In Depreciation cover a large range of printable, free materials available online at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and many more. The appealingness of Original Cost Method In Depreciation lies in their versatility as well as accessibility.

Original Cost Method In Depreciation

Original Cost Method In Depreciation

Original Cost Method In Depreciation -

[desc-5]

[desc-1]

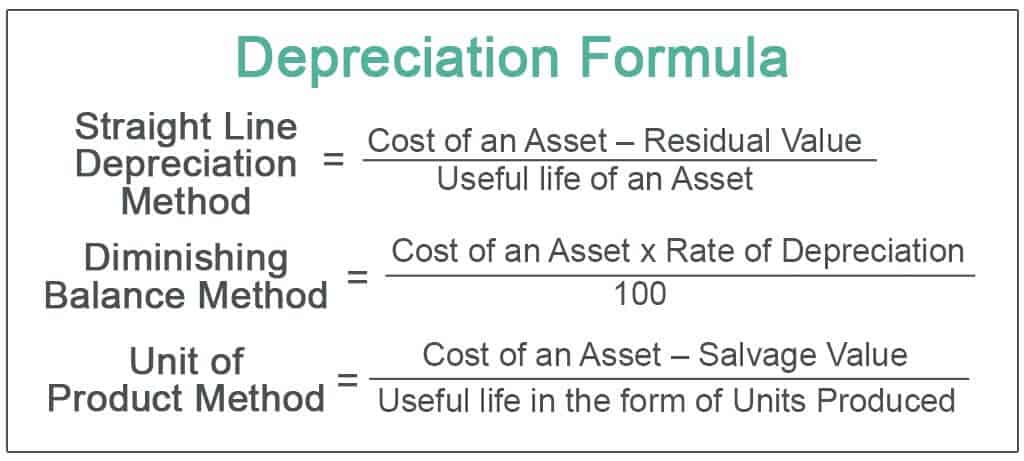

Depreciation Of Building Formula AarranMiska

Depreciation Of Building Formula AarranMiska

[desc-4]

[desc-6]

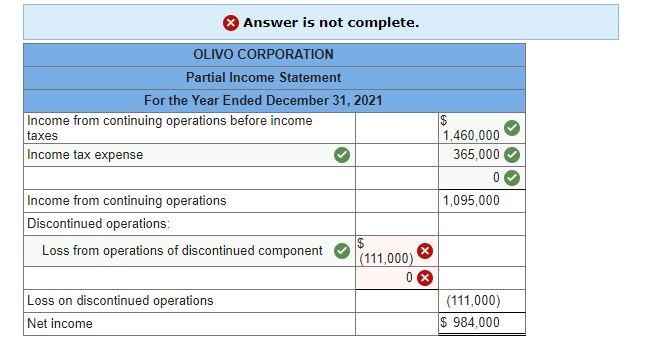

Solved The Diversified Portfolio Corporation Provides Chegg

Solved The Diversified Portfolio Corporation Provides Chegg

[desc-9]

[desc-7]

How To Calculate Depreciation Cost Haiper

Double Declining Balance Method Of Depreciation Accounting Corner

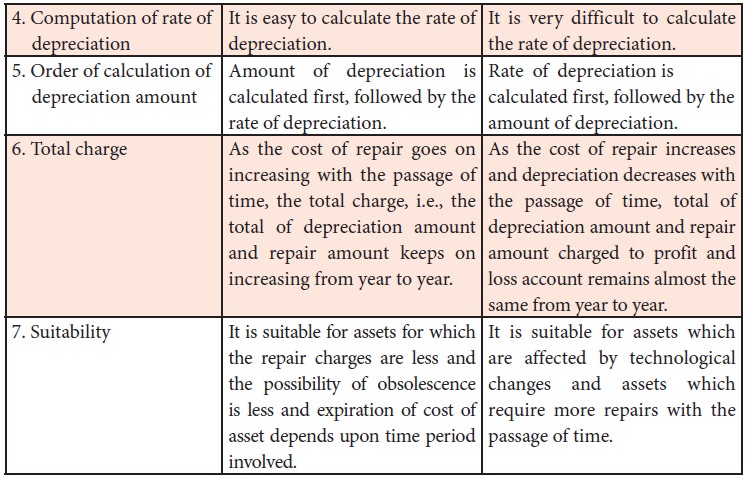

Methods Of Providing Depreciation Different Methods Example Merits

Depreciation And Book Value Calculations YouTube

Question 1 Calculate The Rate Of Depreciation Under Straight Line

Solved A Machine Costing 214 000 With A Four year Life And An

Solved A Machine Costing 214 000 With A Four year Life And An

Depreciation Straight Line Method Or Original Cost Method Lecture 1