In a world where screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. If it's to aid in education in creative or artistic projects, or just adding an individual touch to the space, What Are Non Qualified Medical Expenses For Hsa are now a useful resource. Through this post, we'll take a dive deep into the realm of "What Are Non Qualified Medical Expenses For Hsa," exploring what they are, where you can find them, and how they can enrich various aspects of your daily life.

Get Latest What Are Non Qualified Medical Expenses For Hsa Below

What Are Non Qualified Medical Expenses For Hsa

What Are Non Qualified Medical Expenses For Hsa -

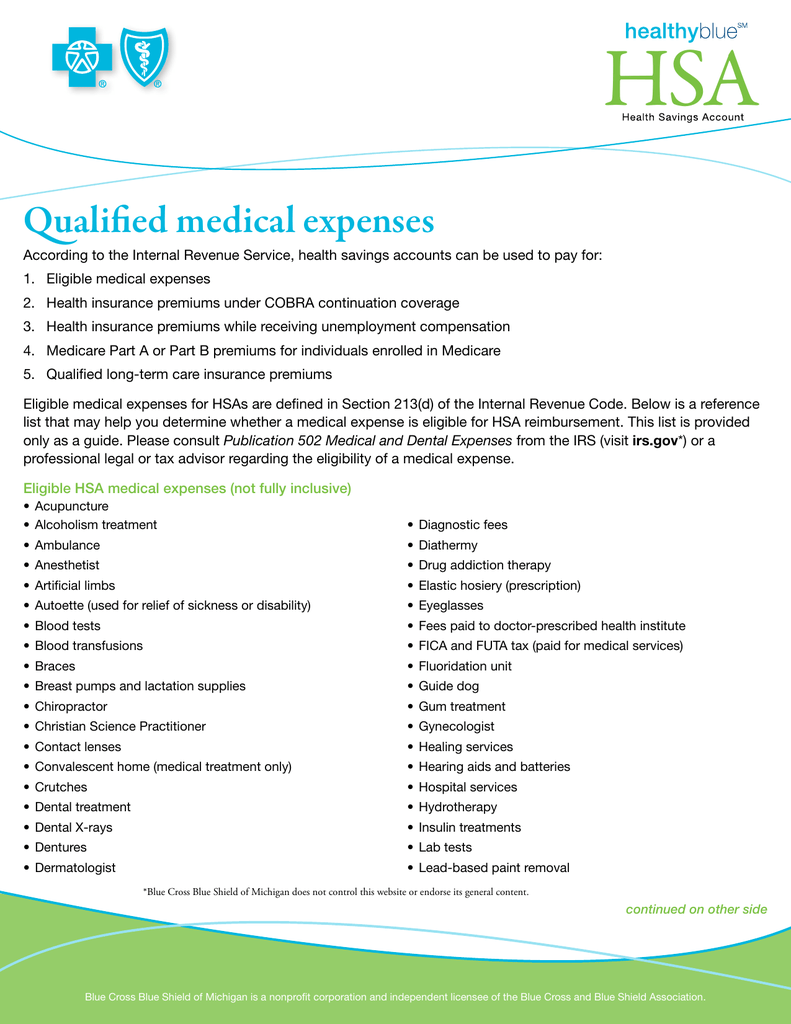

The IRS has a broad list of expenses related to medical dental and vision care that it considers as qualified expenses for HSAs As long as you spend your HSA funds on any of these

To be considered a qualified medical expense QME the expense must be incurred after the HSA is established and must qualify for the medical and dental expense tax deduction IRS Publication 502 Medical and Dental Expenses contains an inexhaustive list of such expenses including the cost of doctors fees prescriptions and

What Are Non Qualified Medical Expenses For Hsa cover a large collection of printable resources available online for download at no cost. They come in many designs, including worksheets coloring pages, templates and many more. The appealingness of What Are Non Qualified Medical Expenses For Hsa lies in their versatility as well as accessibility.

More of What Are Non Qualified Medical Expenses For Hsa

Can I Invest The Money In My HSA FSA Insurance Neighbor

Can I Invest The Money In My HSA FSA Insurance Neighbor

Generally qualified medical expenses for HSA purposes are unreimbursed medical expenses that could otherwise be deducted on Schedule A Form 1040 or 1040 SR See the Instructions for Schedule A and Pub 502 Medical and Dental Expenses Expenses incurred before you establish your HSA are not qualified medical expenses

Non qualified medical expenses The federal penalty for using HSA funds for non qualified expenses is 20 percent if you are under age 65 plus the loss of tax free treatment for the distribution Keep itemized receipts and copies of prescriptions for over the counter drugs in case of an IRS audit Concierge services

The What Are Non Qualified Medical Expenses For Hsa have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: You can tailor print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free are designed to appeal to students from all ages, making them an invaluable aid for parents as well as educators.

-

The convenience of You have instant access various designs and templates reduces time and effort.

Where to Find more What Are Non Qualified Medical Expenses For Hsa

Flexible Spending Account Example Eligible Medical Expenses

Flexible Spending Account Example Eligible Medical Expenses

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

With the CARES Act in place items that were once considered non qualifying medical expenses are now eligible expenses That s good news Now over the counter drugs Hello allergy medication Goodbye seasonal sneezing and menstrual products are considered qualified medical expenses and you can use your HSA bucks to pay for

Now that we've piqued your interest in What Are Non Qualified Medical Expenses For Hsa, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of What Are Non Qualified Medical Expenses For Hsa for various uses.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing What Are Non Qualified Medical Expenses For Hsa

Here are some creative ways ensure you get the very most of What Are Non Qualified Medical Expenses For Hsa:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Are Non Qualified Medical Expenses For Hsa are a treasure trove of useful and creative resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the vast array that is What Are Non Qualified Medical Expenses For Hsa today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Are Non Qualified Medical Expenses For Hsa truly cost-free?

- Yes they are! You can download and print these files for free.

-

Can I make use of free printables in commercial projects?

- It's based on the rules of usage. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with What Are Non Qualified Medical Expenses For Hsa?

- Some printables may have restrictions on use. Make sure you read the terms and conditions set forth by the author.

-

How do I print What Are Non Qualified Medical Expenses For Hsa?

- You can print them at home using printing equipment or visit a print shop in your area for more high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are in PDF format. They can be opened with free software, such as Adobe Reader.

5 Things To Know About Health Savings Accounts ThinkHealth

Health Savings Account Qualified Medical Expenses MTB Management

Check more sample of What Are Non Qualified Medical Expenses For Hsa below

FSA Eligible Expense List Flexbene

529 Plans Qualified And Non Qualified Expenses

What You Need To Know About Health Savings Accounts HSAs

Health Savings Account HSA Qualified Medical Expenses YouTube

What Is Fsa hra Eligible Health Care Expenses Judson Lister

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

HSA Qualified Medical Expenses

https://thelink.ascensus.com/articles/2024/2/14/...

To be considered a qualified medical expense QME the expense must be incurred after the HSA is established and must qualify for the medical and dental expense tax deduction IRS Publication 502 Medical and Dental Expenses contains an inexhaustive list of such expenses including the cost of doctors fees prescriptions and

https://www.investopedia.com/articles/personal...

Who Can Open a Health Savings Account According to the federal guidelines you can open and contribute to an HSA if you Are covered under a qualifying high deductible health plan which

To be considered a qualified medical expense QME the expense must be incurred after the HSA is established and must qualify for the medical and dental expense tax deduction IRS Publication 502 Medical and Dental Expenses contains an inexhaustive list of such expenses including the cost of doctors fees prescriptions and

Who Can Open a Health Savings Account According to the federal guidelines you can open and contribute to an HSA if you Are covered under a qualifying high deductible health plan which

Health Savings Account HSA Qualified Medical Expenses YouTube

529 Plans Qualified And Non Qualified Expenses

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

What Is Fsa hra Eligible Health Care Expenses Judson Lister

HSA Qualified Medical Expenses

FSA Vs HSA What s The Difference Excellent Overview

What Qualifies For HSA Medical Expenses Ramsey

What Qualifies For HSA Medical Expenses Ramsey

HSA HRA HEALTHCARE FSA AND DEPENDENT CARE ELIGIBILITY LIST