In this day and age where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses in creative or artistic projects, or simply adding a personal touch to your space, What Percentage Of Medical Expenses Can You Claim On Your Taxes can be an excellent resource. Here, we'll dive deep into the realm of "What Percentage Of Medical Expenses Can You Claim On Your Taxes," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest What Percentage Of Medical Expenses Can You Claim On Your Taxes Below

What Percentage Of Medical Expenses Can You Claim On Your Taxes

What Percentage Of Medical Expenses Can You Claim On Your Taxes -

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

You can get your deduction by taking your AGI and multiplying it by 7 5 If your AGI is 50 000 only qualifying medical expenses over 3 750 can be deducted

What Percentage Of Medical Expenses Can You Claim On Your Taxes cover a large variety of printable, downloadable material that is available online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The benefit of What Percentage Of Medical Expenses Can You Claim On Your Taxes lies in their versatility and accessibility.

More of What Percentage Of Medical Expenses Can You Claim On Your Taxes

Claim Medical Expenses On Your Taxes Health For CA

Claim Medical Expenses On Your Taxes Health For CA

General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical

Can I claim medical expenses on my taxes If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them a useful resource for educators and parents.

-

Convenience: Quick access to many designs and templates reduces time and effort.

Where to Find more What Percentage Of Medical Expenses Can You Claim On Your Taxes

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

Your medical expense deduction will only begin to count after it surpasses 10 percent or more of your adjusted gross income or AGI this is your total pre tax

The medical expense tax deduction allows taxpayers to deduct qualified medical expenses that exceed a certain percentage of their adjusted gross income AGI For the tax years 2023 and 2024

We hope we've stimulated your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of What Percentage Of Medical Expenses Can You Claim On Your Taxes to suit a variety of objectives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing What Percentage Of Medical Expenses Can You Claim On Your Taxes

Here are some ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

What Percentage Of Medical Expenses Can You Claim On Your Taxes are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and hobbies. Their availability and versatility make these printables a useful addition to both professional and personal lives. Explore the wide world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free templates for commercial use?

- It's contingent upon the specific terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on usage. Be sure to review the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer or go to the local print shop for premium prints.

-

What software do I require to open printables at no cost?

- A majority of printed materials are with PDF formats, which can be opened with free software, such as Adobe Reader.

What Non work Expenses Can You Claim On Your Tax Return

How Much Of Your Medical Expenses Are Deductible On Your Taxes

Check more sample of What Percentage Of Medical Expenses Can You Claim On Your Taxes below

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

Can I Claim Medical Expenses On My Taxes TMD Accounting

Can I Claim Medical Expenses On My Taxes

How To Create A Simple Expenses Claim Form Template Free Sample

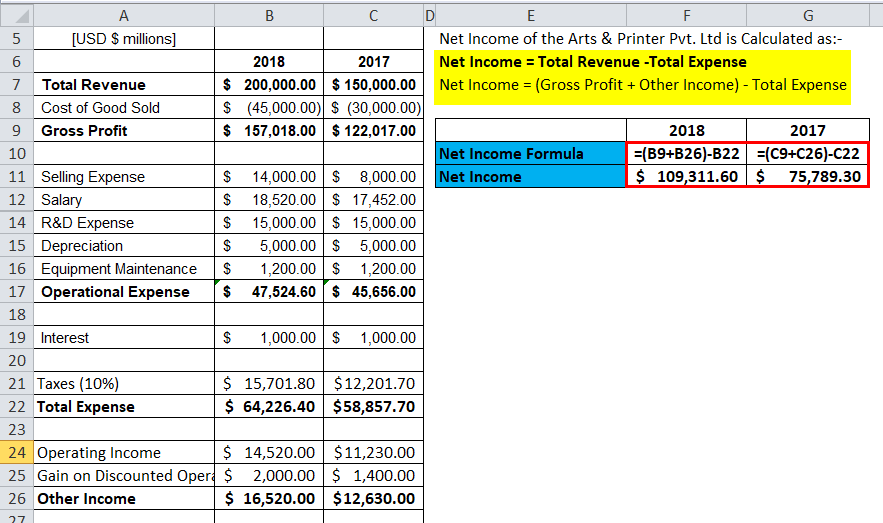

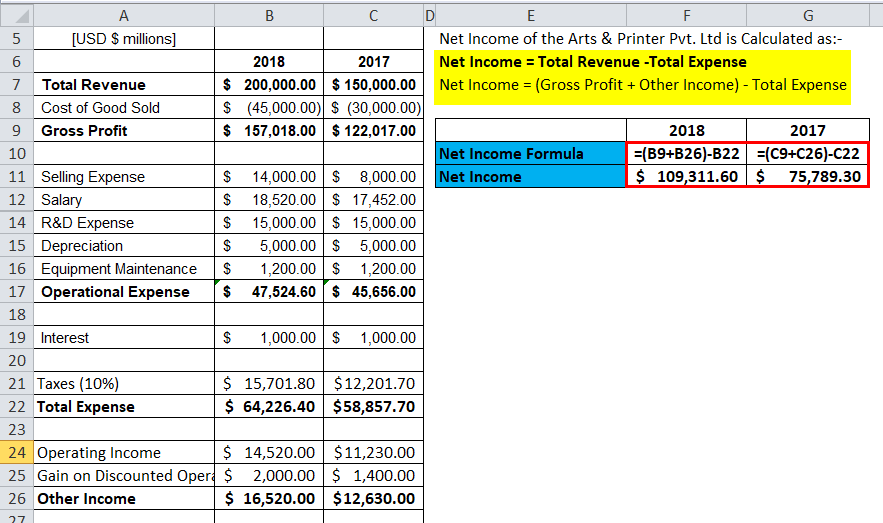

How To Calculate Total Expenses From Total Revenue And Owners Equity

https://smartasset.com/taxes/medical-expense-deduction

You can get your deduction by taking your AGI and multiplying it by 7 5 If your AGI is 50 000 only qualifying medical expenses over 3 750 can be deducted

https://turbotax.intuit.com/tax-tips/health-care/...

Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form

You can get your deduction by taking your AGI and multiplying it by 7 5 If your AGI is 50 000 only qualifying medical expenses over 3 750 can be deducted

Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form

Can I Claim Medical Expenses On My Taxes

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

How To Create A Simple Expenses Claim Form Template Free Sample

How To Calculate Total Expenses From Total Revenue And Owners Equity

What Are Expenses Its Types And Examples TutorsTips

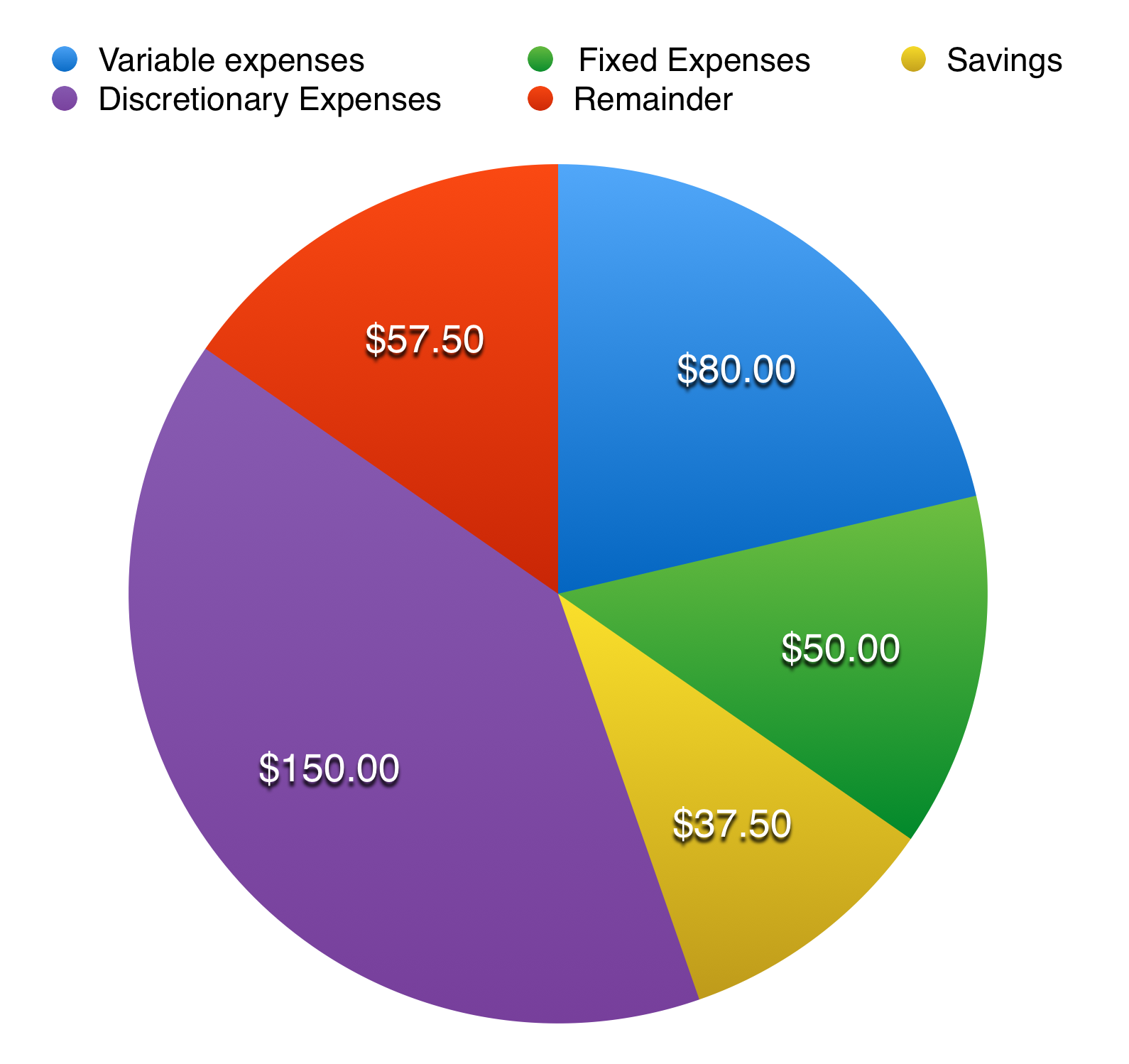

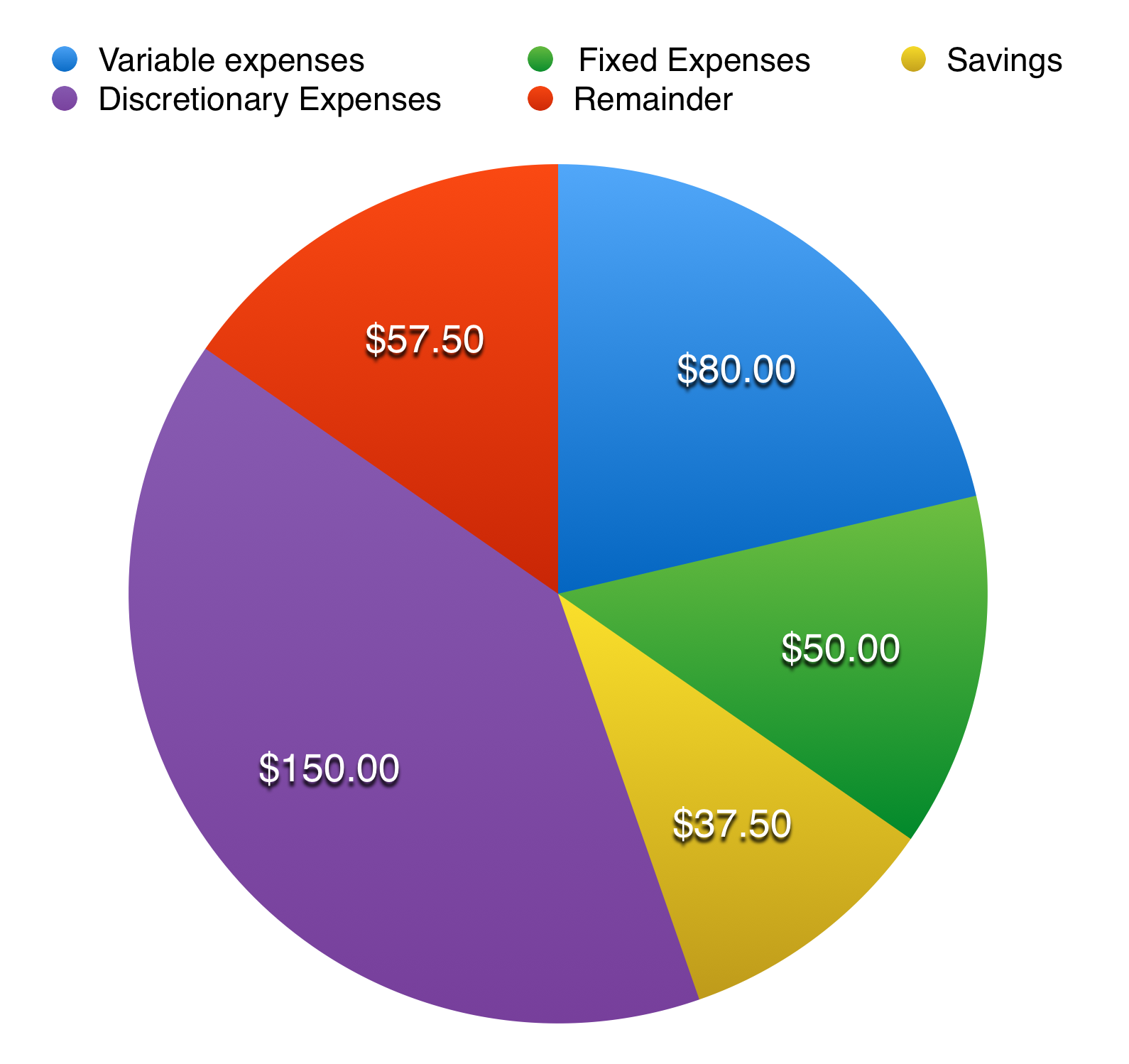

Budgeting Financial Literacy

Budgeting Financial Literacy

Medical Expenses You Can Claim Back From Tax Multiply Blog