In this age of electronic devices, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. For educational purposes as well as creative projects or just adding personal touches to your home, printables for free are a great source. With this guide, you'll take a dive in the world of "What Expenses Can Be Deducted From The Sale Of A Home," exploring the different types of printables, where you can find them, and how they can add value to various aspects of your lives.

Get Latest What Expenses Can Be Deducted From The Sale Of A Home Below

What Expenses Can Be Deducted From The Sale Of A Home

What Expenses Can Be Deducted From The Sale Of A Home - What Expenses Can Be Deducted From The Sale Of A Home, What Expenses Can Be Deducted From The Sale Of A Second Home, Can You Deduct Expenses For Selling A Home, What Costs Can You Deduct When Selling A Home, What Expenses Are Deductible When Selling A House

Luckily many of the pricey parts of homeownership large renovations mortgage interest and property tax can be deducted to lower what the IRS requires you to pay taxes on when you sell Ways to

5 Tax Deductions to Take When Selling a Home Selling costs Home improvements and repairs Property taxes Mortgage interest Capital gains tax What Is Capital Gains Tax on Real Estate

What Expenses Can Be Deducted From The Sale Of A Home cover a large assortment of printable, downloadable material that is available online at no cost. They come in many formats, such as worksheets, templates, coloring pages and more. The great thing about What Expenses Can Be Deducted From The Sale Of A Home is their versatility and accessibility.

More of What Expenses Can Be Deducted From The Sale Of A Home

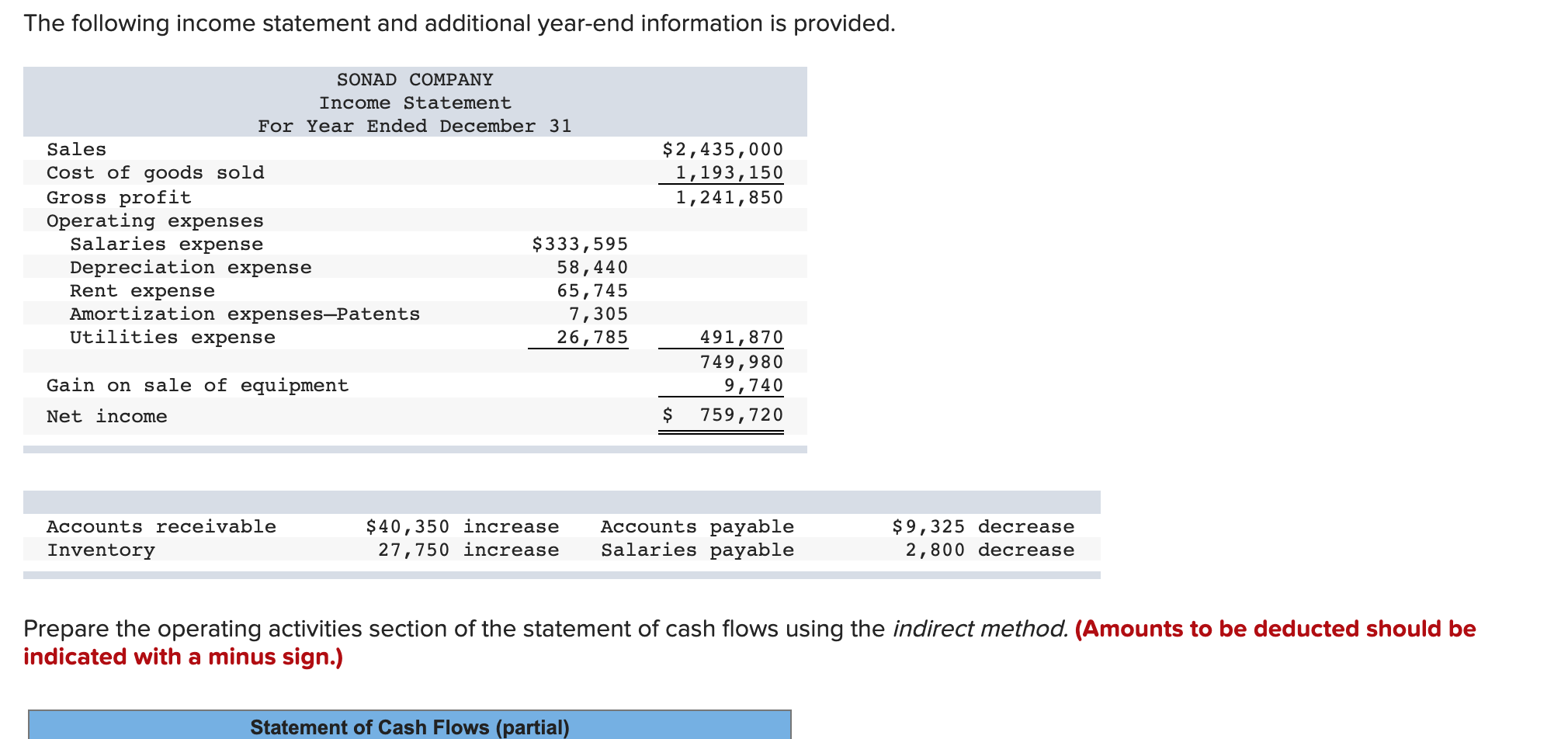

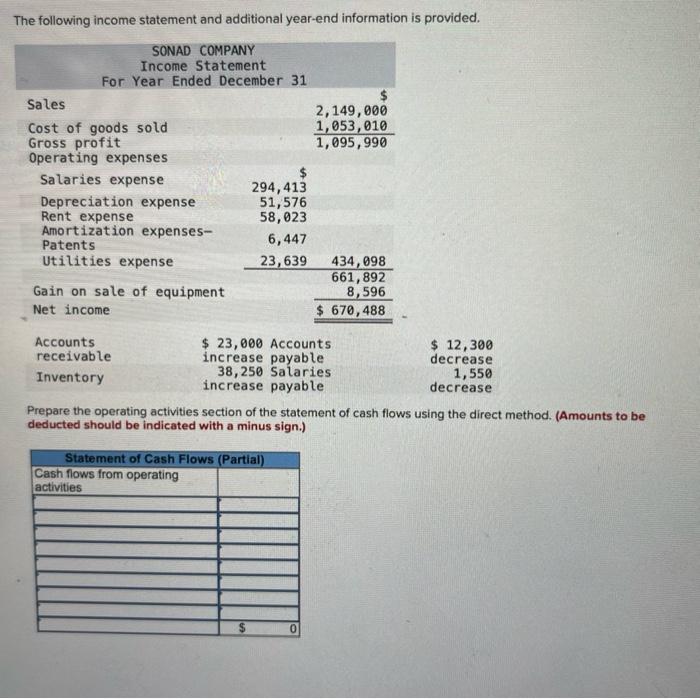

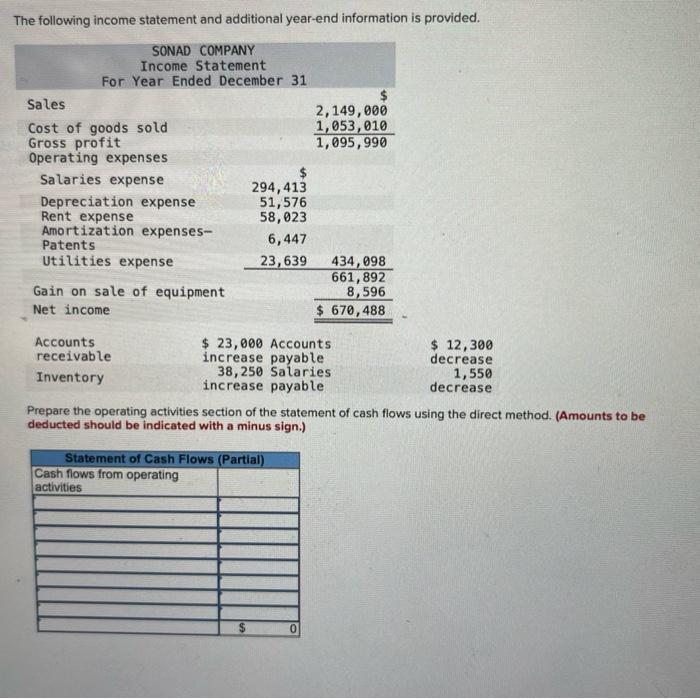

Solved The Following Income Statement And Additional Chegg

Solved The Following Income Statement And Additional Chegg

If the amount you realize which generally includes any cash or other property you receive plus any of your indebtedness the buyer assumes or is otherwise

In short home cleaning expenses have no tax benefit The only home sale expenses you can deduct are those that don t physically affect the property such as real estate broker

What Expenses Can Be Deducted From The Sale Of A Home have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization You can tailor printed materials to meet your requirements when it comes to designing invitations to organize your schedule or decorating your home.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages, making them an invaluable resource for educators and parents.

-

Accessibility: Access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more What Expenses Can Be Deducted From The Sale Of A Home

Can Mortgage Be Deducted From Rental Income Debt ca

Can Mortgage Be Deducted From Rental Income Debt ca

Home Sellers Taxes Regulations by Cody Tromler August 25 2022 The Skinny On Tax Deductions When Selling A House If you sold your home in the last

If you aren t itemizing deductions on your return for the year in which you sold your home skip to Reporting Other Income Related to Your Home Sale later There is no tax

Now that we've piqued your curiosity about What Expenses Can Be Deducted From The Sale Of A Home Let's look into where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in What Expenses Can Be Deducted From The Sale Of A Home for different goals.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide range of topics, that range from DIY projects to party planning.

Maximizing What Expenses Can Be Deducted From The Sale Of A Home

Here are some ways in order to maximize the use of What Expenses Can Be Deducted From The Sale Of A Home:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

What Expenses Can Be Deducted From The Sale Of A Home are an abundance of creative and practical resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make they a beneficial addition to both professional and personal lives. Explore the endless world of What Expenses Can Be Deducted From The Sale Of A Home today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can download and print these items for free.

-

Can I use the free printables for commercial purposes?

- It depends on the specific rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright problems with What Expenses Can Be Deducted From The Sale Of A Home?

- Certain printables may be subject to restrictions in their usage. Check these terms and conditions as set out by the designer.

-

How can I print What Expenses Can Be Deducted From The Sale Of A Home?

- You can print them at home using either a printer or go to the local print shops for top quality prints.

-

What software must I use to open printables for free?

- A majority of printed materials are in the PDF format, and can be opened with free software, such as Adobe Reader.

Solved The Following Income Statement And Additional Chegg

What Can Be Deducted From Taxes H R Block

Check more sample of What Expenses Can Be Deducted From The Sale Of A Home below

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

Preschool Can Help You Save On Your Taxes

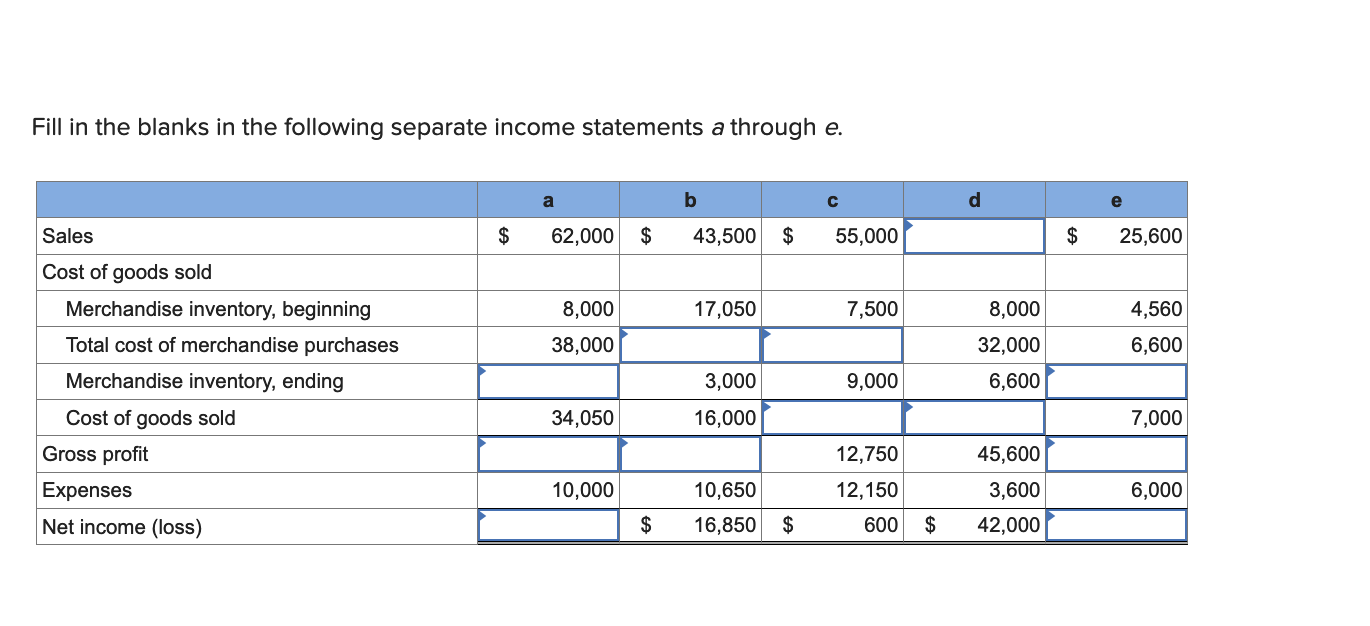

Solved Fill In The Blanks In The Following Separate Income Chegg

Visualizing Taxes Deducted From Your Paycheck In Every State

List Of Non Allowable Expenses Deductible Business Expenses

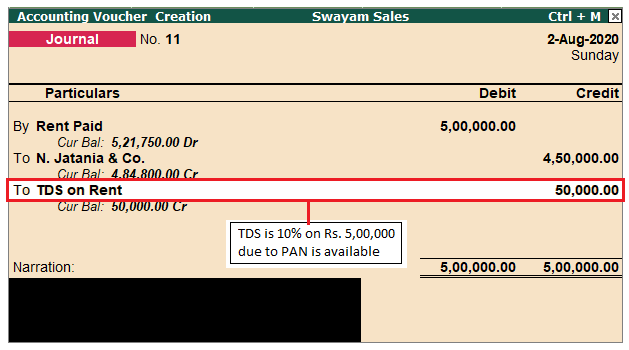

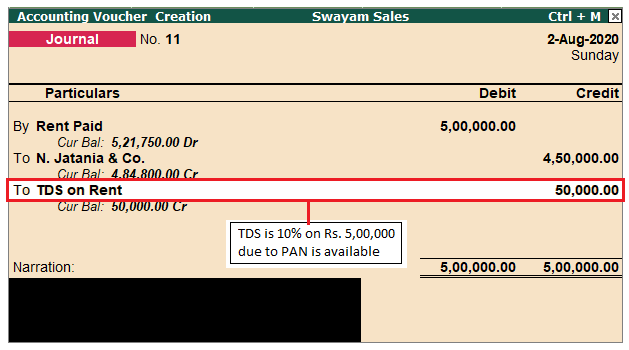

How To Record TDS Payment Entry In Tally ERP 9

https://www.realtor.com/guides/homeo…

5 Tax Deductions to Take When Selling a Home Selling costs Home improvements and repairs Property taxes Mortgage interest Capital gains tax What Is Capital Gains Tax on Real Estate

https://www.homelight.com/blog/what-e…

There is literally no deductible expense that a seller of their principal residence can take that s any different from when they were living in and owning the home Schippa explains They can deduct only

5 Tax Deductions to Take When Selling a Home Selling costs Home improvements and repairs Property taxes Mortgage interest Capital gains tax What Is Capital Gains Tax on Real Estate

There is literally no deductible expense that a seller of their principal residence can take that s any different from when they were living in and owning the home Schippa explains They can deduct only

Visualizing Taxes Deducted From Your Paycheck In Every State

Preschool Can Help You Save On Your Taxes

List Of Non Allowable Expenses Deductible Business Expenses

How To Record TDS Payment Entry In Tally ERP 9

What Can Be Deducted From Employee Wages

Are You Unsure What Expenses Are Deductible For You Business This

Are You Unsure What Expenses Are Deductible For You Business This

How To Claim Expenses When You re Self employed Courier